For InRento, securing investments is a crucial aspect of buy-to-let crowdfunding financing operations. A key part of this security is making sure that all properties financed through the platform are insured at all times during the investment period. But there's a catch that not everyone knows about: simply having an insurance policy isn't enough. If the policy isn't paid for, it's not valid.

To address this, InRento requires property owners to provide both the insurance policy and proof that they've paid for it. This ensures that every investment is truly protected. To keep things transparent, InRento shows all these documents on each project's page on their website. This way, investors can easily find and check the insurance policies and payment proofs themselves.

This approach not only ensures that investments are safe but also builds trust by making sure investors have all the information they need right at their fingertips.

Real-Life Application of Insurance: Z8, Vilnius project incident

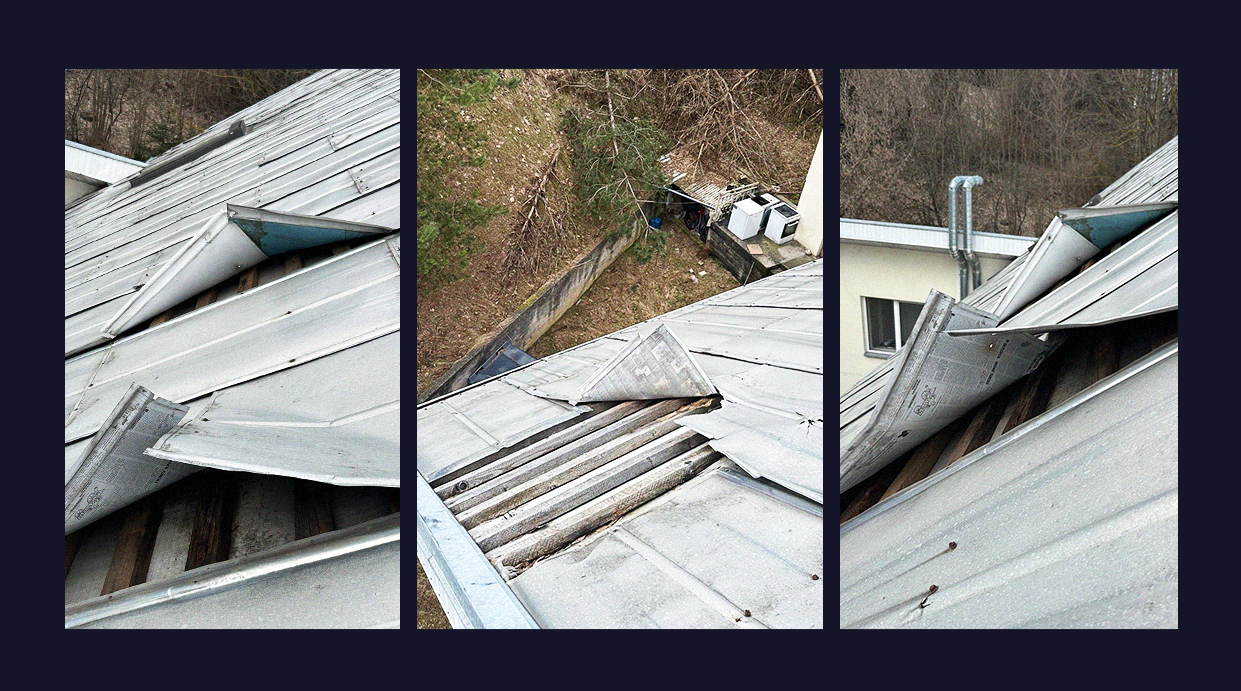

Last week, MB Rego properties, a project owner on the InRento platform, encountered a significant insurance event at project Z8 in Vilnius. The property faced an unexpected challenge when very heavy winds caused substantial damage to the roof construction, resulting in severe impairment to parts of the roof.

Prompt Response and Comprehensive Coverage

Fortunately, the property was fully insured, with all premiums up to date, showcasing the foresight and diligence in maintaining necessary protections against unforeseen events. The swift and effective response to this incident highlights the practical benefits of InRento's insurance requirements.

Insurance Company's Decision: A Relief for Investors and the Project Owner

The insurance company, after evaluating the damage, confirmed that they would compensate for all the losses incurred by MB Rego properties due to the extreme weather conditions. This decision is a testament to the robustness of the insurance coverage and its critical role in safeguarding the interests of both project owners and investors. The assurance from the insurance company that all damages will be covered means that there's no risk of the project's collateral value decreasing because of this incident.

Maintaining Investment Value and Trust

This event demonstrates the practical importance of having comprehensive insurance coverage for investment properties. It not only protects the physical assets but also ensures that the investors’ interests are safeguarded, maintaining the trust and confidence placed in the platform and the project owners. By adhering to strict insurance policies and ensuring their effective implementation, InRento has shown that it stands by its commitment to investment security, even in the face of unpredictable challenges.

Conclusion: A Testament to Proactive Risk Management

The incident at Project Z8, Vilnius serves as a clear example of why insurance is a crucial component of investment security strategy. It highlights InRento's commitment to proactive risk management and its ability to handle challenges efficiently, ensuring that both investors and project owners are protected against unforeseen events. This reinforces the value of transparency and diligence in the real estate crowdfunding sector, proving that preparedness and the right safeguards can mitigate risks and preserve investment integrity.