To date, 57 projects have been fully realised, with EUR 12.3 million in principal repaid to investors – all on time and without a single delay. Our investors have earned over EUR 5.2 million in interest, which highlights the strength and consistency of our offered investment model.

It’s already been half a decade since I began writing these quarterly investor updates, and I find it genuinely rewarding to see that our diligent and conservative approach continues to deliver the same strong performance – even now, as we operate at a much larger scale than when we started.

Expanding Beyond Borders

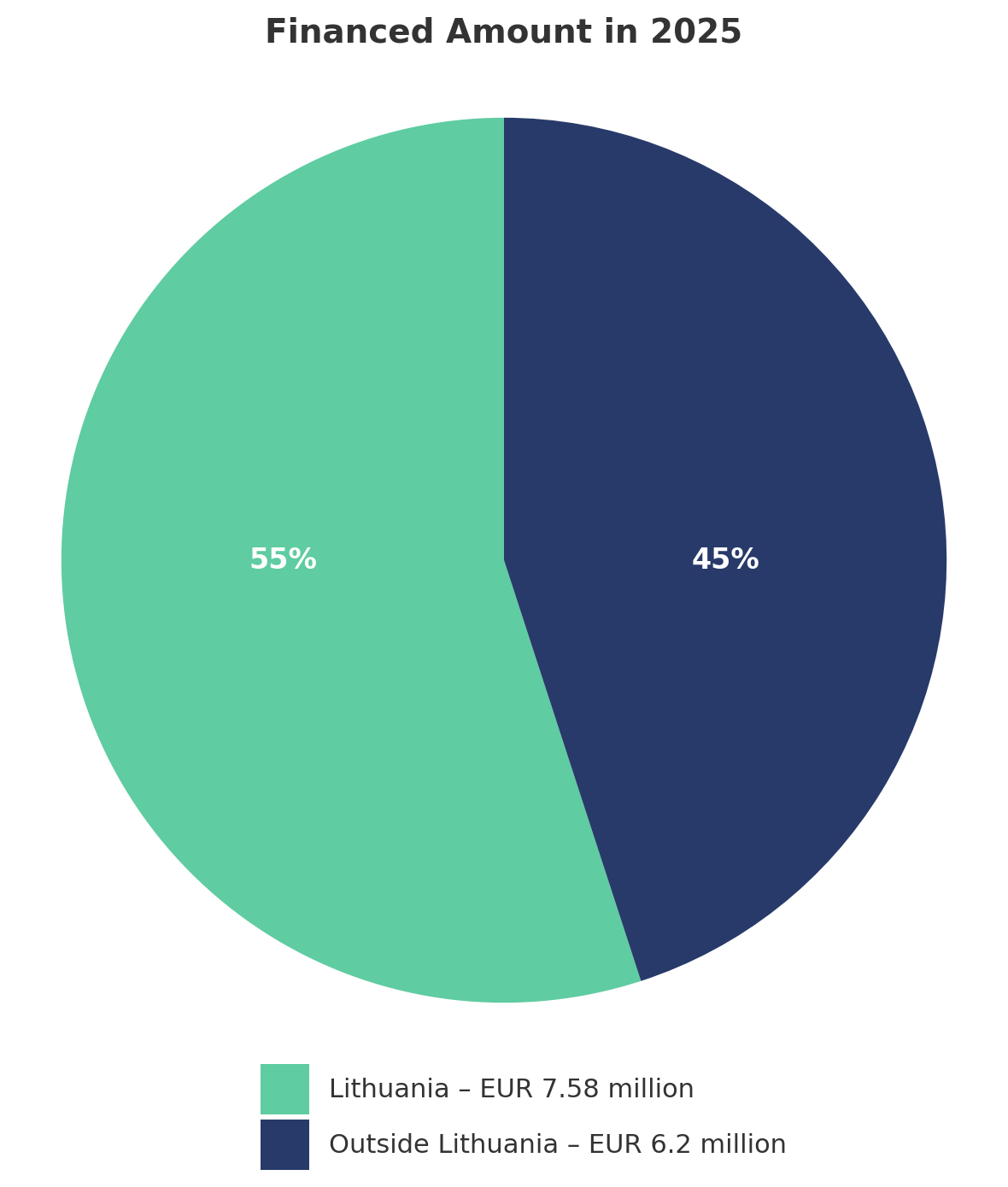

InRento has become a true pan-European platform. This year alone:

- Over EUR 6.2 million has been invested outside Lithuania, now accounting for 45% of our total portfolio;

- We launched operations in Italy, making it our fifth active market after Lithuania, Poland, Ireland, and Spain;

- We opened a dedicated office in Warsaw, cementing our position as Poland’s leading buy-to-let platform.

In the upcoming quarter, we plan to introduce a new investment market. Meanwhile, we’re in the process of opening our third physical office in Europe and building out our presence by hiring local teams on the ground. More updates on these developments will follow soon.

Discover full statistics here

Poland: Exceptional Returns and Successful Realisations

I’ve been saying this for years – and I’ll keep repeating it: Poland offers one of the most attractive risk/reward ratios in all of Europe. This year, our goal is to finance more deals in Poland than in any other country, and that’s no coincidence. It’s the result of a clear strategic direction and focused expansion plan that we’ve been consistently executing for the third consecutive year.

Three Polish projects have already been successfully completed this year, ahead of schedule and with yields above expectations – including a project in Krynica-Zdrój that delivered a 12.35% return (vs. the projected 11.5%). Warsaw, Kraków, and Poznań remain key cities on InRento radar for new investment opportunities.

Record-Breaking Momentum

June marked two new records for InRento:

- EUR 3.5 million invested in a single month;

- Over EUR 400,000 in interest paid to our investors.

This growth is not just volume – it's quality. Most projects continue to outperform initial return expectations, with no defaults recorded to date.

European Recognition & Continued Innovation

InRento was proudly named “LendTech of the Year” at the European FinTech Awards 2025 – a recognition that reflects our growing impact on the crowdfunding and property investment landscape across Europe.

As I shared in our press release, and would like to emphasise again:

“Our model is built on transparency and investor-first principles – monthly income, capital gains, and mortgage-backed security – all with no defaulted loans.”

This achievement would not have been possible without the dedication of our exceptional team, the trust of our clients, and the ongoing support of our international partners. Thank you for being part of this journey – we’re just getting started.

New Market, Same Confidence: Italy

We successfully launched our first Italian project – a 4-star hotel in Catania, Sicily. The EUR 520,000 funding goal was reached in just over an hour, reflecting both strong investor confidence and growing demand for high-quality, diversified opportunities. Projects like this embody our mission to offer tangible, secure, and geographically diversified investments across Europe.

As I mentioned at the start of this year, hospitality is a key focus for us in 2025. We’re seeing a continued upward trend in the tourism sector post-COVID, with an increasing number of hotels being acquired, renovated, and repositioned for growth. These dynamics present compelling opportunities for our investors – and we’re committed to identifying and delivering the best of them.

Diversification & Security First

We continue to emphasise geographic diversification and rigorous risk management. Almost half of our current projects are based outside of Lithuania, enabling investors to diversify their risk across multiple real estate markets.

“We don’t sell dreams – we offer numbers that work and investments that perform,” says D. Urbanovičius.

Here’s InRento in Numbers (as of Q2 2025):

- Number of new investment opportunities: 13;

- Average investment return p.a.: 11.99%;

- Repaid amount of principal investments: EUR 4,634,902;

- Default and late projects: 0;

- Amount financed: EUR 6,225,916.