We are pleased to announce that the buy-to-let project Forest 22, Vilnius has been successfully realised. The project’s annual return exceeded expectations – instead of the projected 9%, the actual average annual return across all stages reached 22.34%.

Realised project stages performance:

- First stage actual return – 18.01%;

- Second stage actual return – 17.69%;

- Third stage actual return – 21.53%;

- Fourth stage actual return – 32.11%.

The final return on investment depends on the investor’s invested amount – investors who invested EUR 100,000 or more were entitled to up to 30% variable capital gains.

The investment offer consisted of a 753.29 sq. m. building located in Vilnius, at Sutemų Str. 22. The project involved converting the entire premises to include 25 residential units ranging from 18 to 35 sq. m., designed for rental and future property realisation.

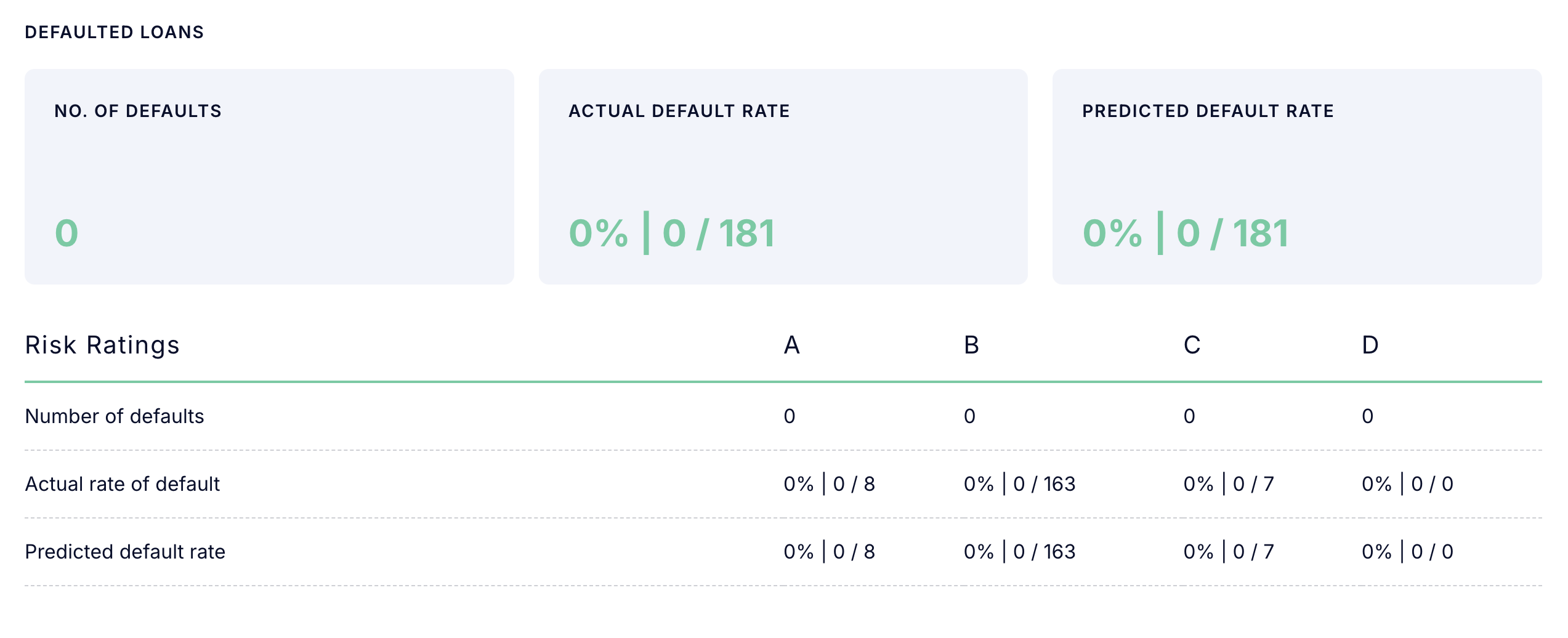

The successful completion of the Forest 22, Vilnius project once again demonstrates the stability of our portfolio. A total of EUR 1,010,000 has been returned to investors and more than EUR 127,000 in capital gains have been paid. The InRento portfolio remains strong, with the default rate across all granted loans staying at 0.

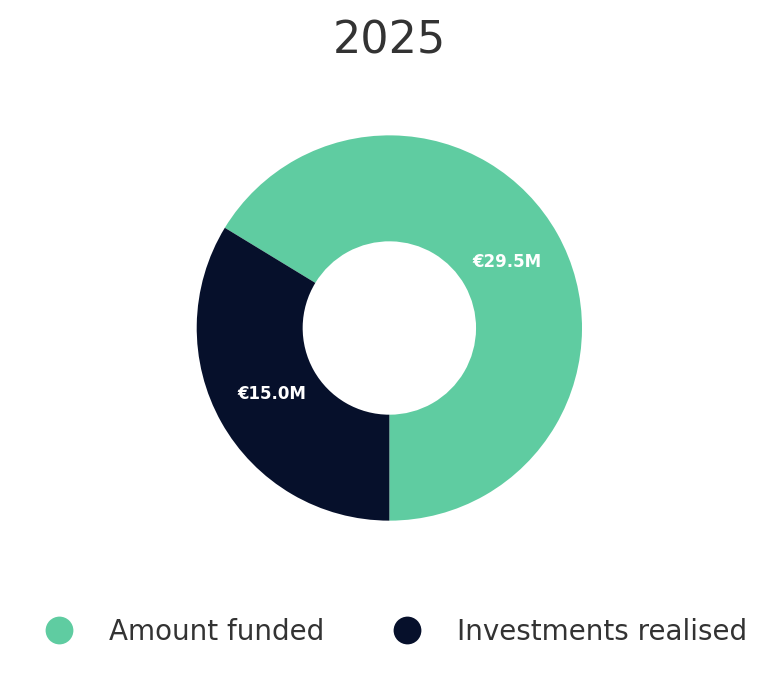

In 2025, investors have earned more than EUR 3 million in interest payments, while the total value of realised investments has amounted to more than EUR 15 million.

More than EUR 29.5 million in new investments have already been funded this year, and the average return performs at a competitive 11.38% p.a.

In addition to the monthly interest payments, the returned investments have also generated additional capital gains, which are paid out upon completion of the projects. This further increases the total return and provides even greater benefits to investors.

To date, the total value of realised investments has amounted to EUR 21.01 million – a strong reflection of the platform’s stability and consistent performance.

0 default rate on all historical loans. Discover full statistics here.