2025-09-24

We are pleased to announce that the project – Z8, Vilnius, has been fully realized.

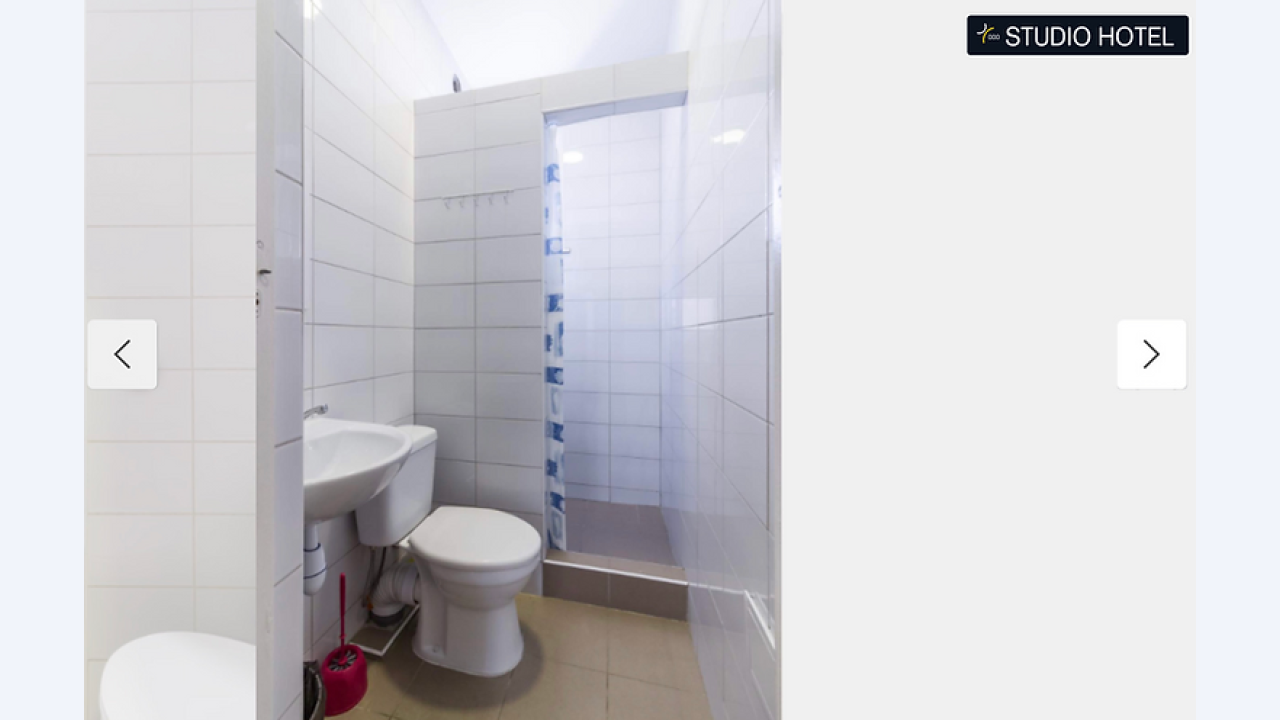

The investment offer consisted of a hotel located in an attractive part of the Vilnius city – between the Žvėrynas and Šeškinė districts, at the address Želvos Str. 8.

The total average annual return to investors in this project was higher than expected, reaching 9.49% instead of 7.12%.

The disbursement of funds is currently underway and will be distributed within 2 working days.

2023-03-14

We would like to inform you that InRento has transferred the investors the share of the profit of InRento, which is distributed on the sale of the Project Assets. However, these changes will not have any effect on the profit amounts that could be distributed to the investors. Please find a detailed explanation below.

Previously, the investor’s profit share was set based on the investment amount:

Invested up to EUR 5,000 – 30%;

Invested from EUR 5,000 EUR (inclusive) up to EUR 15,000 – 35%;

Invested from EUR 15,000 EUR (inclusive) up to EUR 30,000 – 40%;

Invested from EUR 30,000 EUR (inclusive) up to EUR 50,000 – 45%;

Invested from EUR 50,000 EUR (inclusive) – 50%.

After InRento has transferred its share of the profit, all investors’ share of the profit is equal to 50%. However, based on the amount invested, an accounting fee may be applied:

Invested up to EUR 5,000 – 0.4;

Invested from EUR 5,000 (inclusive) up to EUR 15,000 – 0.3;

Invested from EUR 15,000 (inclusive) up to EUR 30,000 – 0.2;

Invested from EUR 30,000 (inclusive) up to EUR 50,000 – 0.1;

Invested from EUR 50,000 (inclusive) – 0 (investment terms have not changed).

In the case of this project, for a certain group of investors in case of profit payout, the net amount grows. Below you can find an example and comparison of how a payout of 100 EUR changes based on the previous and updated structure:

Previous structure:

Invested up to EUR 5,000 – payable profit 30 EUR = 30% * EUR 100;

Invested from EUR 5,000 (inclusive) up to EUR 15,000 – payable profit 35 EUR = 35% * EUR 100;

Invested from EUR 15,000 (inclusive) up to EUR 30,000 – payable profit 40 EUR = 40% * EUR 100;

Invested from EUR 30,000 (inclusive) up to EUR 50,000 – payable profit 45 EUR = 45% * EUR 100;

Invested from EUR 50,000 (inclusive) payable profit 50 EUR = 50% * EUR 100 (investment terms have not changed).

From now:

Invested up to EUR 5,000 – payable profit 30 EUR = 50% * EUR 100 * (1-0.4). The amount has not changed.

Invested from EUR 5,000 (inclusive) up to EUR 15,000 – payable profit 35 EUR = 50% * EUR 100 * (1-0.3). The amount has not changed.

Invested from EUR 15,000 (inclusive) up to EUR 30,000 – payable profit 40 EUR = 50% * EUR 100 * (1-0.2). The amount has not changed.

Invested from EUR 30,000 (inclusive) up to EUR 50,000 – payable profit 45 EUR = 50% * EUR 100 * (1-0.1). The amount has not changed.

Invested from EUR 50,000 (inclusive) payable profit 50 EUR = 50% * EUR 100 * (1-0.00). Investment terms have not changed.

We are introducing this fee in order to optimize and standardize the methodology of internal accounting procedures and resources, due to the reason the payable amounts and percentages range between projects. This is an operationally intensive process. Additionally, for every payment InRento facilitates, it pays service fees to payment services providers, and in order to ensure cash flow positive operations, a decision was taken to introduce a percentage based tariff on profit rather than gross project profit.

We would like to clarify that investors’ interest from a share of the profit to be distributed on the sale of the assets will be paid out net, which means all applicable fees will be deducted before payment.

2023-03-14

We would like to inform you that InRento has transferred the investors the share of the profit of InRento, which is distributed on the sale of the Project Assets. However, these changes will not have any effect on the profit amounts that could be distributed to the investors. Please find a detailed explanation below.

Previously, the investor’s profit share was set based on the investment amount:

Invested up to EUR 5,000 – 30%;

Invested from EUR 5,000 EUR (inclusive) up to EUR 15,000 – 35%;

Invested from EUR 15,000 EUR (inclusive) up to EUR 30,000 – 40%;

Invested from EUR 30,000 EUR (inclusive) up to EUR 50,000 – 45%;

Invested from EUR 50,000 EUR (inclusive) – 50%.

After InRento has transferred its share of the profit, all investors’ share of the profit is equal to 50%. However, based on the amount invested, an accounting fee may be applied:

Invested up to EUR 5,000 – 0.4;

Invested from EUR 5,000 (inclusive) up to EUR 15,000 – 0.3;

Invested from EUR 15,000 (inclusive) up to EUR 30,000 – 0.2;

Invested from EUR 30,000 (inclusive) up to EUR 50,000 – 0.1;

Invested from EUR 50,000 (inclusive) – 0 (investment terms have not changed).

In the case of this project, for a certain group of investors in case of profit payout, the net amount grows. Below you can find an example and comparison of how a payout of 100 EUR changes based on the previous and updated structure:

Previous structure:

Invested up to EUR 5,000 – payable profit 30 EUR = 30% * EUR 100;

Invested from EUR 5,000 (inclusive) up to EUR 15,000 – payable profit 35 EUR = 35% * EUR 100;

Invested from EUR 15,000 (inclusive) up to EUR 30,000 – payable profit 40 EUR = 40% * EUR 100;

Invested from EUR 30,000 (inclusive) up to EUR 50,000 – payable profit 45 EUR = 45% * EUR 100;

Invested from EUR 50,000 (inclusive) payable profit 50 EUR = 50% * EUR 100 (investment terms have not changed).

From now:

Invested up to EUR 5,000 – payable profit 30 EUR = 50% * EUR 100 * (1-0.4). The amount has not changed.

Invested from EUR 5,000 (inclusive) up to EUR 15,000 – payable profit 35 EUR = 50% * EUR 100 * (1-0.3). The amount has not changed.

Invested from EUR 15,000 (inclusive) up to EUR 30,000 – payable profit 40 EUR = 50% * EUR 100 * (1-0.2). The amount has not changed.

Invested from EUR 30,000 (inclusive) up to EUR 50,000 – payable profit 45 EUR = 50% * EUR 100 * (1-0.1). The amount has not changed.

Invested from EUR 50,000 (inclusive) payable profit 50 EUR = 50% * EUR 100 * (1-0.00). Investment terms have not changed.

We are introducing this fee in order to optimize and standardize the methodology of internal accounting procedures and resources, due to the reason the payable amounts and percentages range between projects. This is an operationally intensive process. Additionally, for every payment InRento facilitates, it pays service fees to payment services providers, and in order to ensure cash flow positive operations, a decision was taken to introduce a percentage based tariff on profit rather than gross project profit.

We would like to clarify that investors’ interest from a share of the profit to be distributed on the sale of the assets will be paid out net, which means all applicable fees will be deducted before payment.

2022-09-21

We would like to inform you that the mortgage on the project – Z8, Vilnius I asset has been successfully placed (the document is attached in the documents section). The interest for the project will be distributed next month.

If you have any questions, do not hesitate to contact us at info@inrento.com or call us at +37069347427.

InRento team