Reasons to invest in the project V3, Palanga II:

Fixed attractive annual rental yield: (6.07-6.57%);

Fixed annual return on capital gains: (+1.75%) (paid at the end of the project);

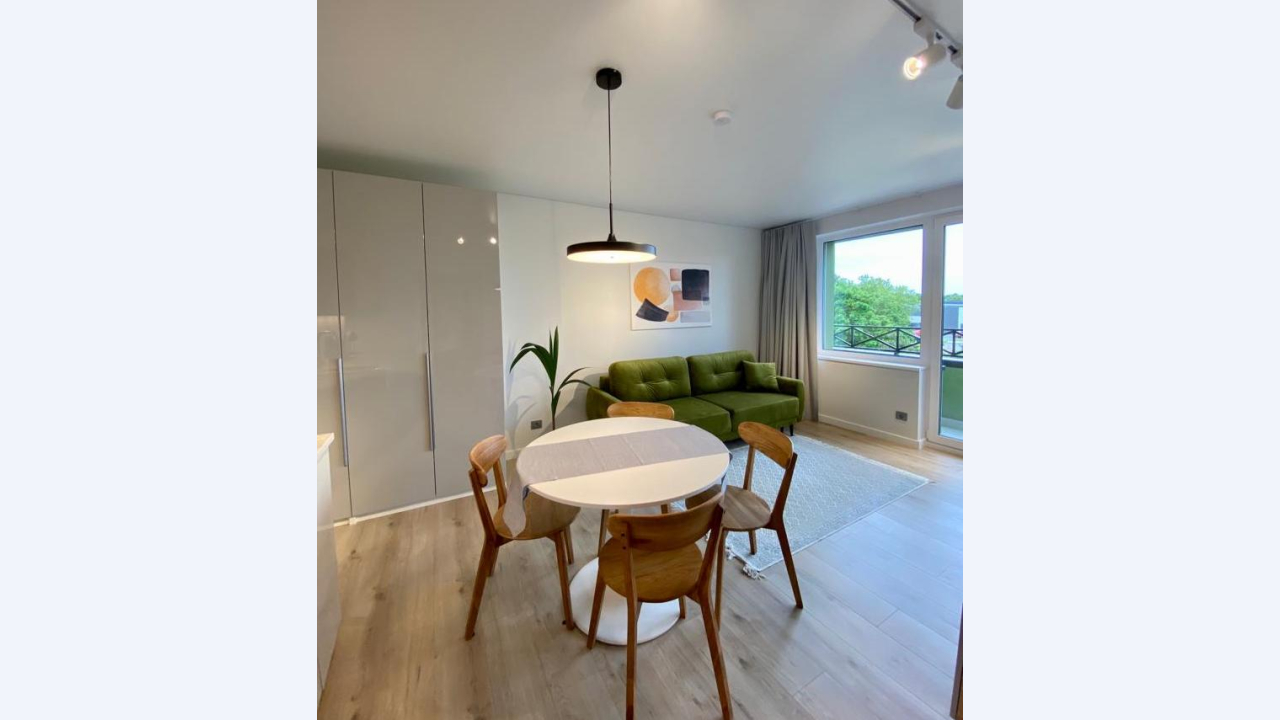

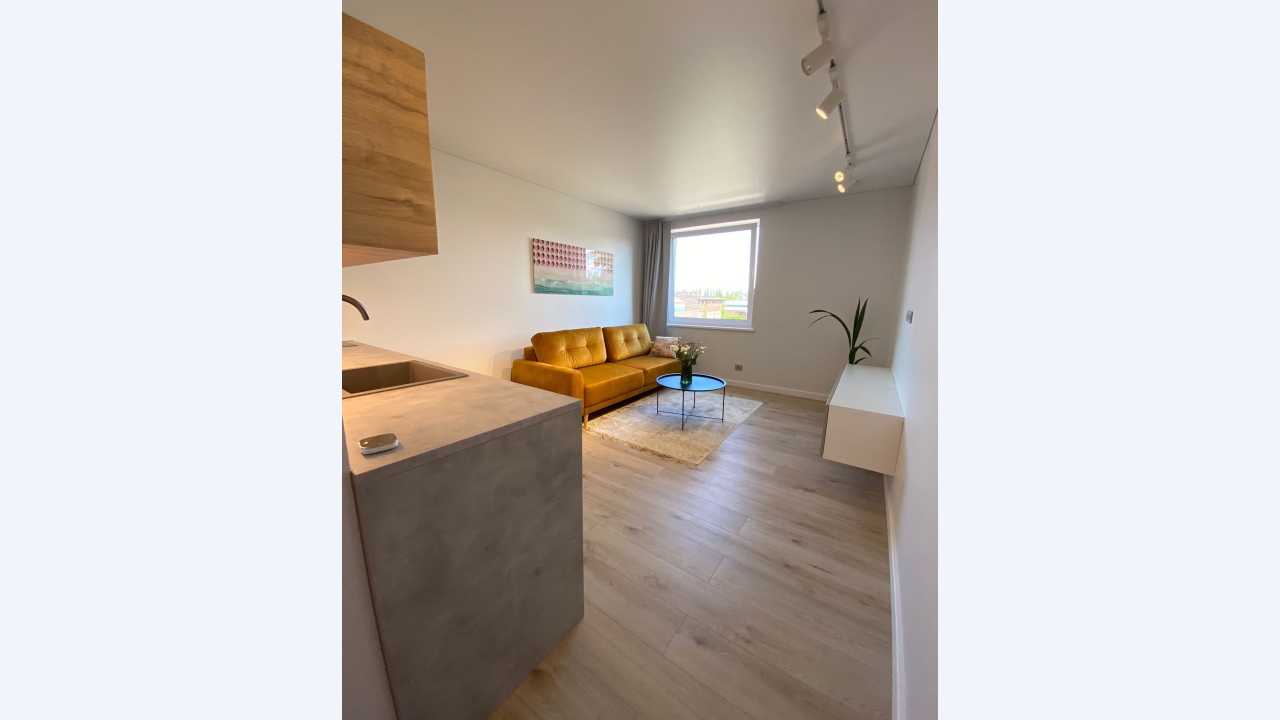

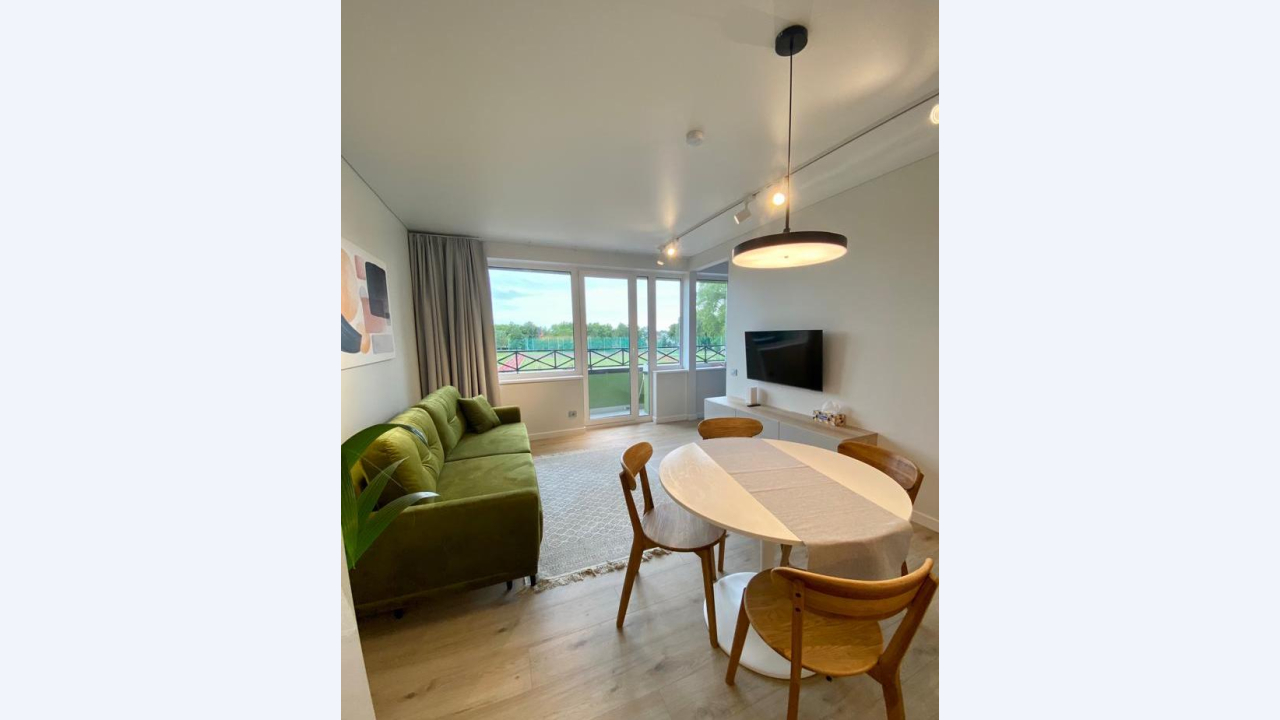

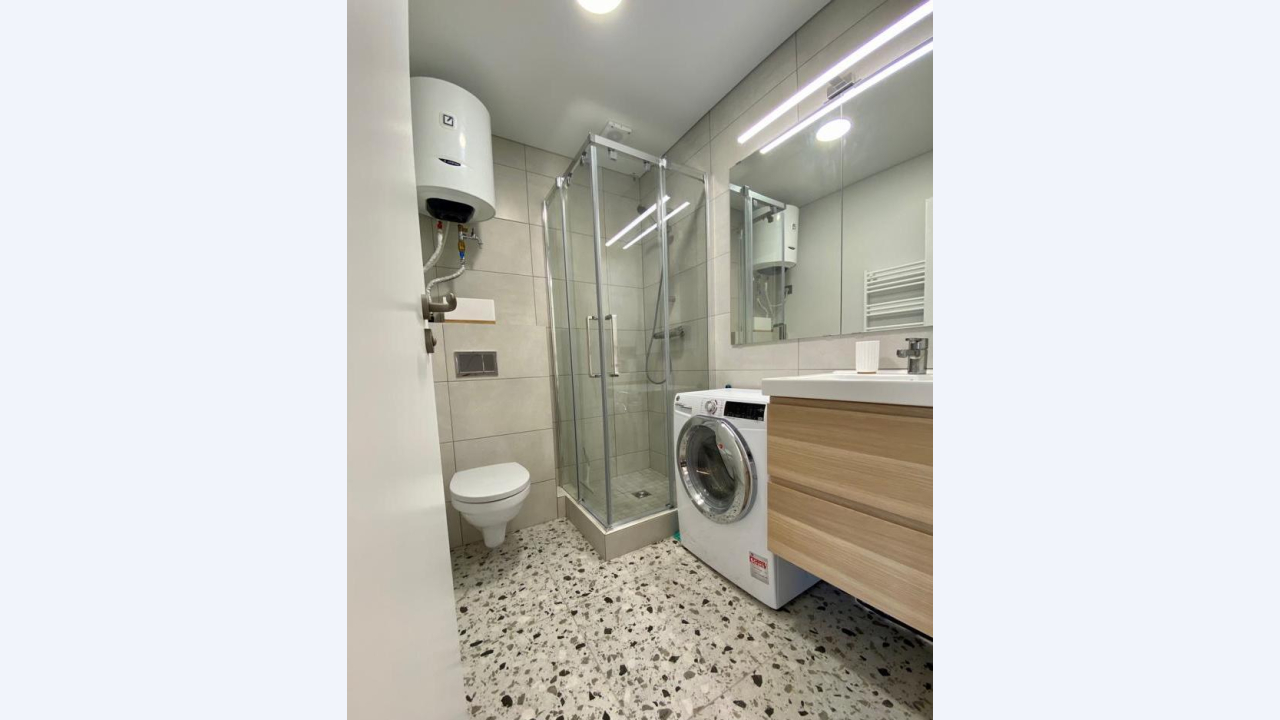

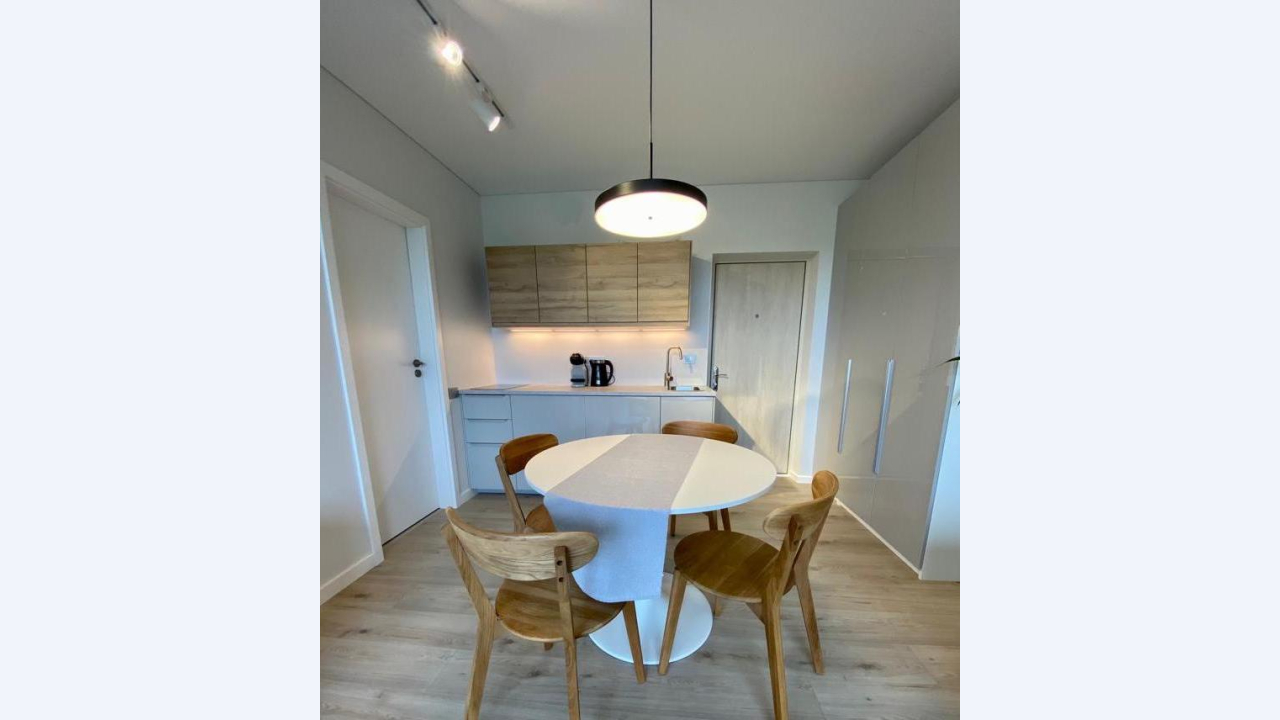

Modern and cozy apartments, less than 1.5 km away, are the main street of the Palanga and the coastline of the Baltic sea;

The fixed annual interest is indexed to inflation;

The independent valuer appraised the premises at EUR 180,000 (updated, the last was at EUR 132,000). The total loan amount for all stages of the project is EUR 124,000.

InRento team present a second and the last Real Estate rental project – V3, Palanga II stage of the financing. The investment opportunity consists of an apartment in one of Lithuania's most popular tourist destinations, a city near the Baltic Sea – Palanga coast. Address: Virbališkių takas 3K, Palanga.

The project owner will pay a fixed 6.07-6.57% annual interest (as a rental return) depending on the amount invested.

Currently, two of the 55.39 m² apartments are furnished and rent for short-term rent. Apartment with two rooms rental price during the season is – 100 EUR a night. The price for the one-room apartment is – 70 EUR. The project owner plans to generate up to EUR 15,000 in rental income per calendar year.

This project is even more attractive as it has a timeshare, meaning that investors are can in these apartments for free if they invest a certain amount (more information at the bottom of the project description).

This project also has a fixed percentage of capital gains. Investors earn a fixed 1.75% return on capital gains per year, which raises the overall return on the project to 7.82% — 8.32% annual return based on the amount invested.

The loan term is only 16 months. After this term, the project owner plans to refinance or sell the property.