The InRento team is launching a new buy to let investment opportunity located in Vilnius. The offer consists of 2 property units for rent located near the central part of the city, address: Švitrigailos str. 11A, Vilnius (referred to as S11-A).

The area of the premises: 35.53 m² and 35.35 m². Currently, the properties are rented out and are generating 570 EUR per month in rental income, which results in an 7.65% gross annual rental yield.

The net monthly rental yield is 513 EUR which is distributed amongst investors, or as a percentage value equal to 6.89% per annum net, according to the circumstances of the tenancy.

Repairs are planned at the end of the premises lease term (carpet replacement and other similar improvements to the premises). This would potentially increase rental yields for investors.

<blur>

Reasons to invest in S11-A project in Vilnius:

- Central location of Vilnius;

- New premises lease agreements have been concluded quite recently;

- Attractive rental yield;

- The project owner has more than 15 years of experience in the field of real estate and successfully pays rental income in other InRent projects;

- The premises have been independently valued at 95,700 EUR.

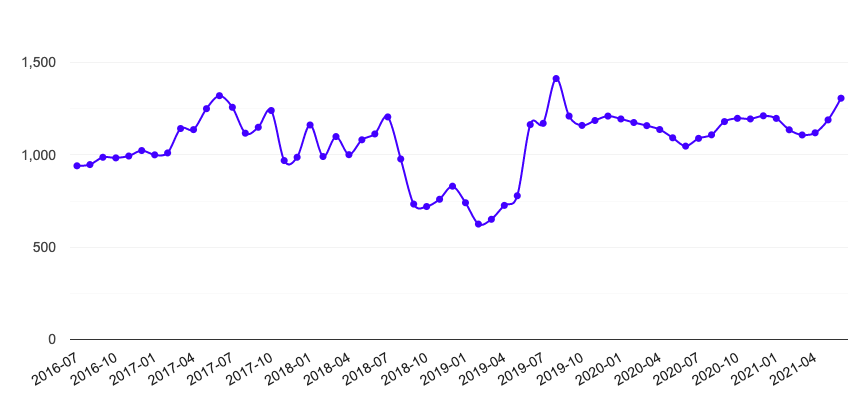

Capital growth change:

According to the latest en.aruodas.lt statistics, the prices of these types of properties in this district of Vilnius increased +19,96% in the recent year, while in the last five years the change was +38,92%.

Source en.aruodas.lt

Tenants:

UAB “Superšeimininkas“ (HOUSEYS). Professional short-term rent management. Technological tools and the strong experienced team ensures optimal occupancy and attractive return for property owners.

Premises: 35.35 m². The company uses these premises as a warehouse, because the location of these premises is convenient for them when administering objects in the Old Town. The tenant will be paying 285 EUR per month for rent and the outstanding new rental contract is valid until 2023-01-31. The tenant has paid the project owner a 3-month lease deposit. In case of the tenant's insolvency, this deposit will be distributed proportionally to investors.

Dovane Holdings Inc. is a foreign company.

Premises area: 35.53 m². The tenant for these premises will be paying 285 EUR per month for rent. The lease is for an indefinite period. The tenant has paid the project owner a 3-month lease deposit. In case of the tenant's insolvency, this deposit will be distributed proportionally to investors.

Financial terms of the investment:

- Maximum term: 84 months (7 years)

- Rental income share: Investors: 90% / Project owner: 10%

- Fixed-interest rate: 2%

- Increased interest rate: 6.5%

- Security: 1st charge Mortgage

InRento investors are effectively granting a loan to the borrower. The loan is secured with a first-charge mortgage, which in case of the borrower’s inability to fulfil financial obligations would be used to repossess the asset.

The revenue-share between the project owner investors is set at 90/10, meaning that the borrower is obliged to distribute 90% of the income to the investors. Current absolute income is 570 EUR per month, which results in 513 EUR net income distribution to the investors, or in a percentage value equal to 6.89% per annum with the given situation of the tenancy.

The capital growth distribution:

- Investors: 60%

- Borrower: 30%

- InRento: 10%

When investing:

15,000 - 29,999 EUR - the capital growth will be distributed in the following structure: 65% investor / 30% borrower / 5% InRento.

30,000 EUR and more - the capital growth will be distributed in the following structure: 70% investor / 30% borrower.

Rental income (interest):

This project rental yield will be distributed on August 15th.

The project owner (borrower):

The borrower - UAB ‘’Real Assets’’, is an established legal entity to serve as a special purpose vehicle for a purpose of increased security for the investments on InRento. The manager of this company - Justas Kaveckas has been working in the Real Estate industry for the last 15 years. He has successfully commercialised residential, commercial and hospitality projects internationally and counts numerous successful sales of companies operating in the real estate industry.

When is it possible to "exit the project"?

When the project is fully funded you will be able to sell your investment on the secondary market. The fee for the secondary market transactions is 2% of the principal value, which is charged to the seller.

What happens if the tenants leave the property?

In a scenario of the tenant cancelling the tenancy, the borrower is liable to pay a 2% annual interest rate for the first month of vacancy. If the borrower does not rent out the assets within 3 months, the fixed-interest rate would be increased to 6.5% per annum.

What will happen when the property is sold?

When the property is sold at a higher price than it was acquired, the capital growth will be distributed in the following structure: 60% investors / 30% borrower / 10% InRento. The project owner assumes potential loss if the property is sold at a lower price.

Key investment risks:

Risk of falling prices: The price of the property might fall due to the increase in supply or decrease in demand in the area or other economic factors.

Liquidity risk: The borrower might be unable to find a buyer in order to sell the property.

Tenant risk: Although the assets are currently fully rented out, there is a risk that the asset can lose a tenant and it can take time to find replacements.

Investing with InRento, is similar to owning a rental property, however with us you don't have to worry about day-to-day property management and in the periods of vacancies, the borrower is required to distribute fixed-interest payments, which protects your bottom line.