Reasons to invest in the project Parkview 33, Ireland:

The project is located in one of Galway's most popular districts, in a prime location with excellent access to the city's most popular points of interest;

Interest is payable monthly with a very attractive annual return of 8% – 8.5%, plus an additional fixed annual capital growth return of +1.5% (payable at the end of the project);

Projected rental income in 2025: EUR 41,850, projected rental profit: EUR 20,493;

The maximum Loan to Value (LTV) ratio for this project: 52%;

The collateral has been valued at EUR 415,000 by an independent appraiser.

The InRento team is presenting the first buy-to-let project in Ireland – Parkview 33.

The investment offer includes a single-storey house with four bedrooms and a side-entrance garage, which the project owner intends to convert into a one-bedroom apartment. At the same time, the property benefits from a fenced front garden and a spacious parking area, which adds to the project's attractiveness.

The project owner plans to subdivide the financed single-storey house into two units, increasing the expected rental income.

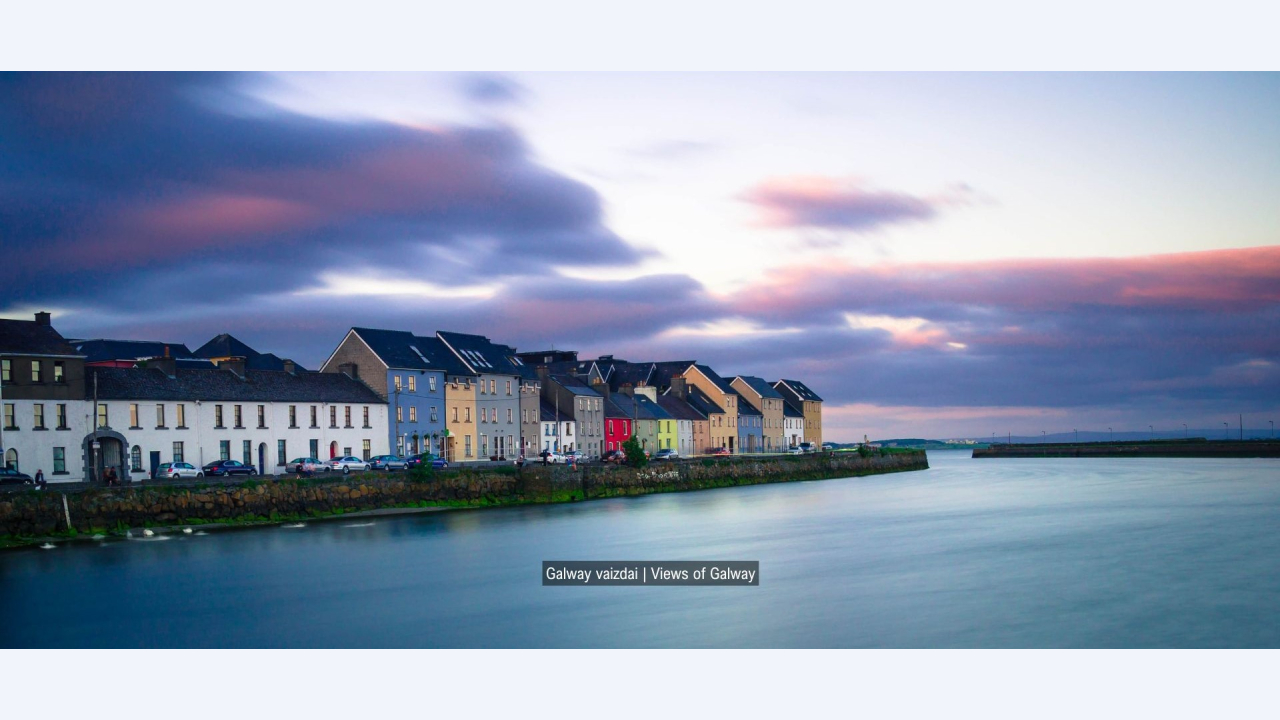

The property is located at 33 Murrough Avenue, Renmore, Galway. Renmore is one of Galway's most popular districts, in a prime location with excellent transport links to the city's most popular points of interest.

The Irish property market is based on strong demographic and economic trends. The population has grown from 4.5 million to 5.3 million over the last decade, and the proportion of young people (19.3%) is the highest in the European Union. At the same time, migration has reached record levels.

Economic growth is also compelling, with Irish GDP expected to grow by 3.6% in 2025, well above the EU average of 1.6%. Favourable tax policies attract global technology and pharmaceutical companies, boosting job growth (+3.4% annually over a decade) and keeping unemployment below 5%. These factors combine to create an unprecedented demand for housing, creating favourable investment conditions.

The project owner aims for an annual profit of at least EUR 20,493 in the first rental year. This creates a large safety margin, as the projected rental income is at least three times the interest payable.

According to daft.ie, one of Ireland's leading property websites, as of 18 November, the supply of rental properties in the Renmore area is minimal. The results show only two rental properties in the area, and the average rental price is around EUR 2,500 per month.

Every month, investors will be paid a fixed interest rate of 8% to 8.5% per annum, depending on the amount invested. The project also has a fixed annual capital growth rate of 1.5%, payable at the end of the project. This raises the overall yield of the project to 9.5% up to 10% per annum.

The maximum loan duration for this project is only 18 months.

The maximum Loan to Value (LTV) ratio for this project: 52%.