Reasons to invest in the project Urban Living, Vilnius I:

The project is financed for a conversion of a complex of fourteen apartments located in an attractive part of Vilnius city;

Interest is payable monthly with an attractive annual return of 10% – 10.5% plus an additional fixed annual capital gains return of +1.5% (payable at the end of the project);

Experienced project owner – has more than 20 years of experience in real estate sales, development and leasing;

Fixed interest linked (indexed) to inflation;

Loan-to-Value (LTV) for the whole project is 70%;

The financed premises have been appraised by an independent appraiser at EUR 603,000.

InRento team presents a new buy-to-let project – Urban Living, Vilnius I. The investment offer consists of premises to be converted to a rental complex of apartments located in Vilnius, at the address – Kalvarijų str. 127.

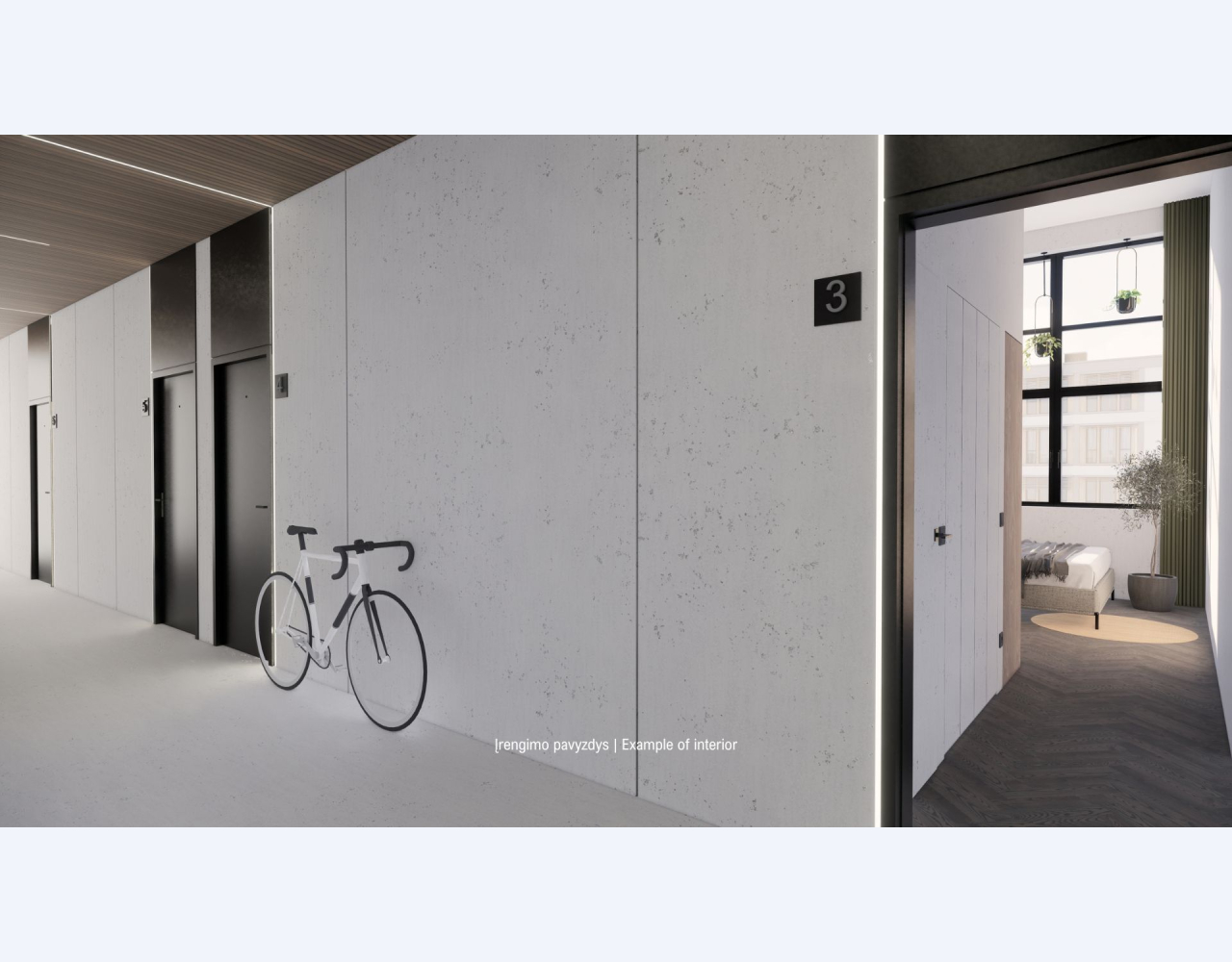

The total area of the financed project is 364.27 m². The plan is to use this space to furnish 14 apartment each room will have private bathrooms, washing machines, TVs and their own kitchens.

This project will be focused towards short-term rentals, but with all the necessary amenities it can easily be refocused towards long-term rentals. Similar concept apartments managed by the same project owner in the building have excellent reviews and ratings on the Booking platform.

The project is conveniently located close to the Twinsbet, the largest arena in the city, the Compensa concert hall and the OZAS and Akropolis shopping centers. Due to its competitive prices, the apartments will be attracting an increasing number of tourists and business people. The growing number of visitors contributes to the high level of bookings throughout the year.

The project owner K129 Living team has more than 20 years of experience in real estate sales, development and rental. Since January 2023, the company has also started to offer additional accommodation services, which will lead to higher profitability.

Investors will be paid a fixed interest rate of 10% – 10.5% per annum each month, depending on the amount invested. The project also has a fixed annual capital growth rate of 1.5%, payable at the end of the project. This raises the overall yield of this phase to between 11.5% and 12% annual return.

The maximum duration of the project is 36 months.