Reasons to invest in the project Demokratų 53, Kaunas:

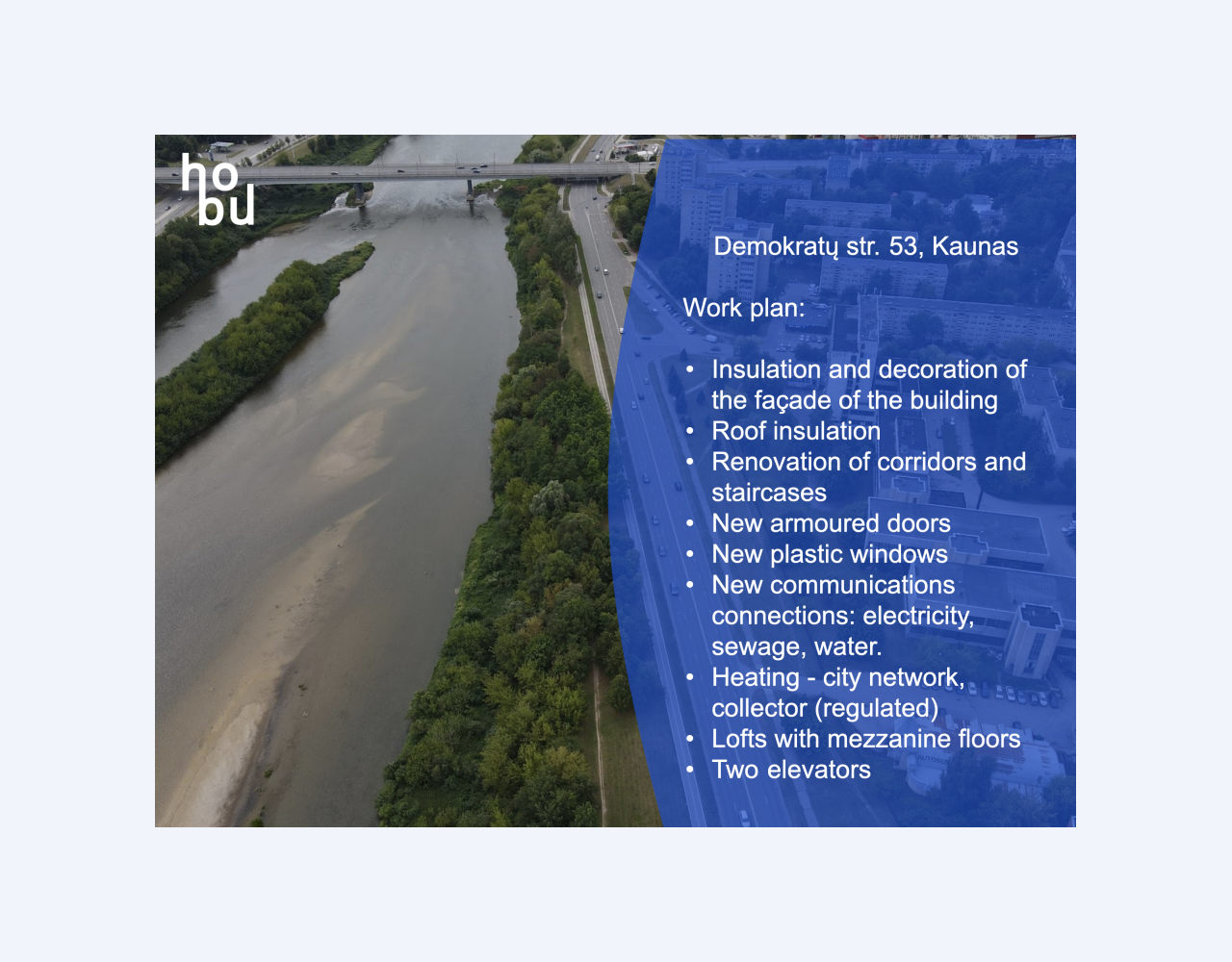

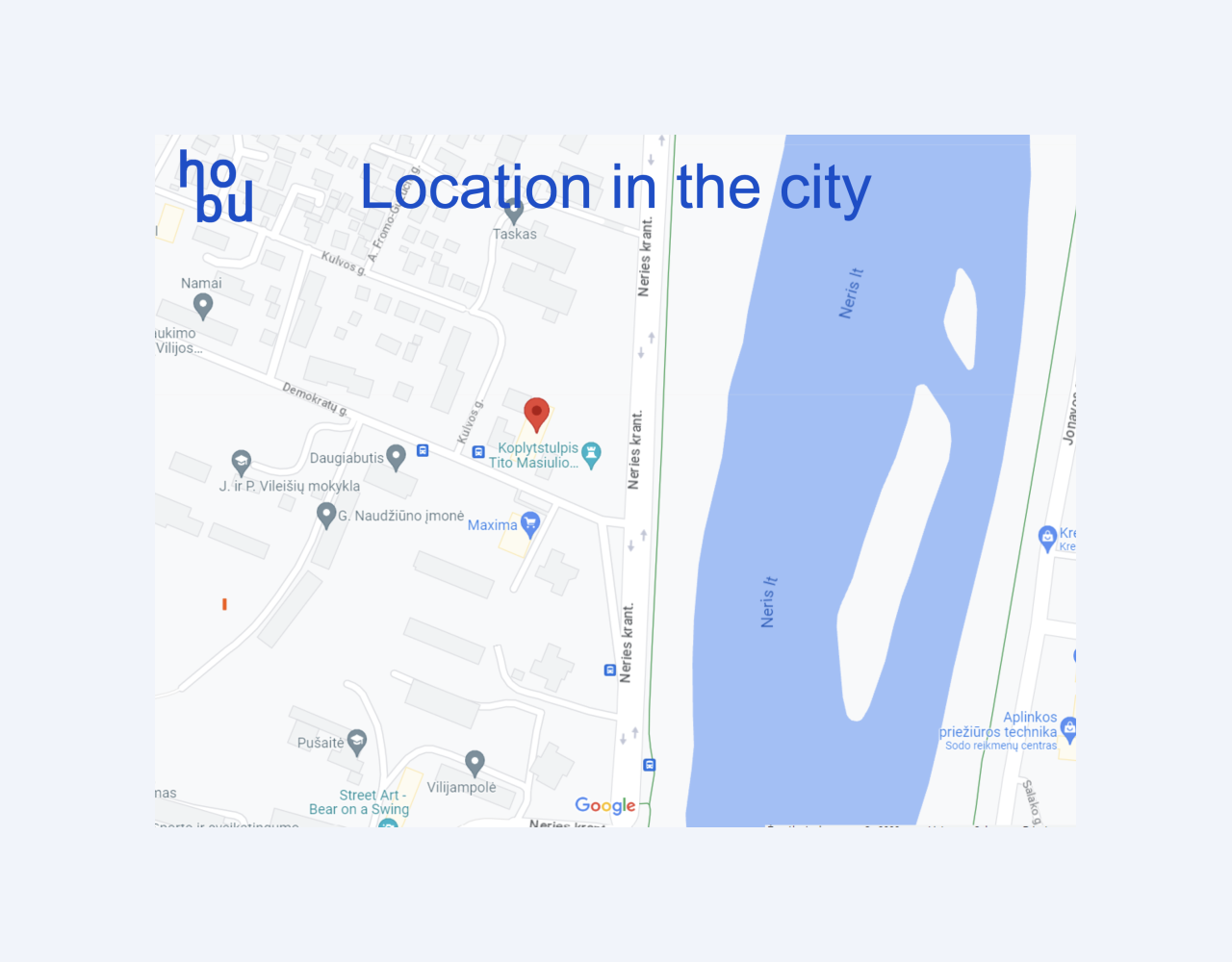

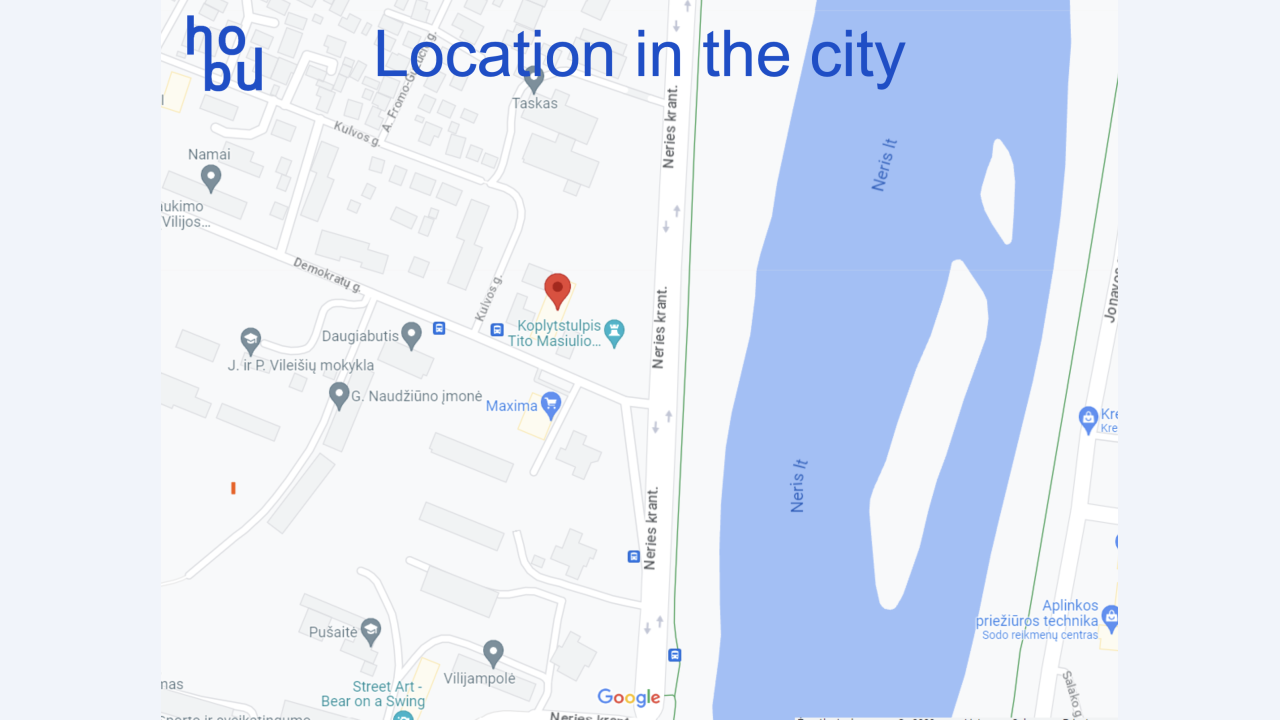

The financed project is located in an attractive location of Kaunas city – right next to the Neris River;

Currently, the project owner has concluded 51 reservation contracts with the buyers for a total amount of EUR 1,580,266, of which EUR 1,087,976 has already been paid.

Interest is payable monthly with a very attractive return of 10% – 10.5% per annum, plus an additional fixed annual return on capital gains: +1.5% (payable at the end of the project);

The project owner is an experienced property developer who has developed large-scale conversion projects;

Loan to Value (LTV) for for the whole project is 53%;

The independent valuer has valued the financed property at EUR 966,000.

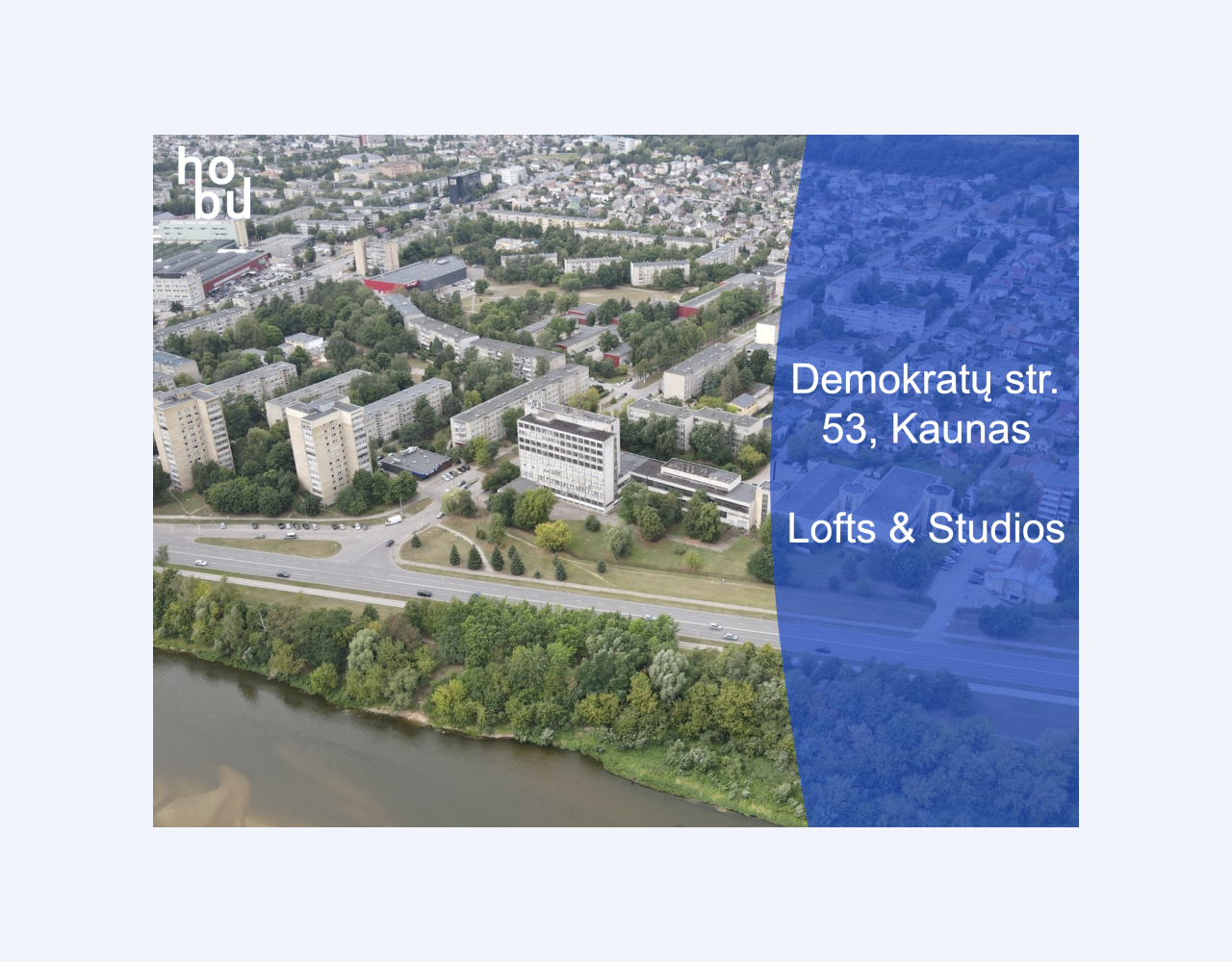

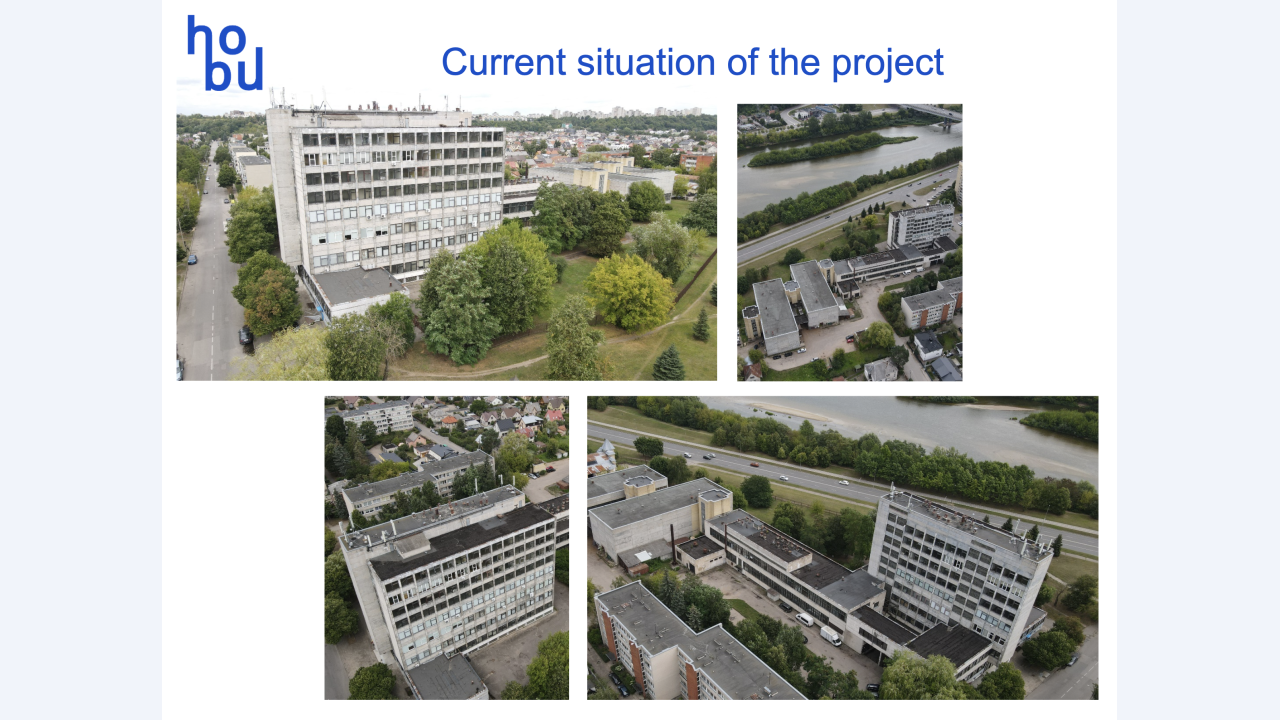

InRento team presents a new buy-to-let project – Demokratų 53, Kaunas I. The investment offer consists of an eight-storey building with a basement located in an attractive location of Kaunas city – right next to the Neris River and only 5 minutes away by car from Kaunas Old Town, located at Demokratų st. 53, Kaunas.

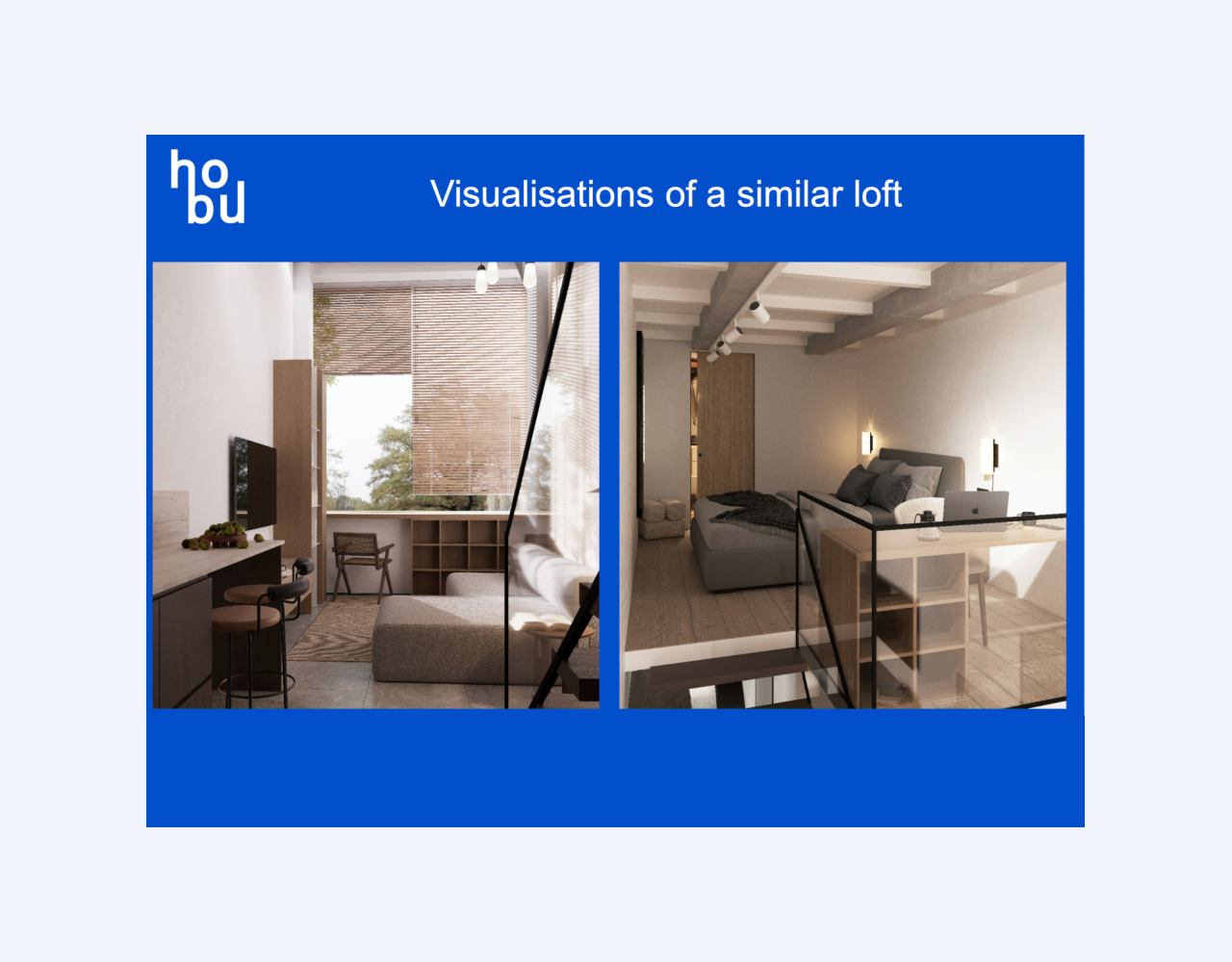

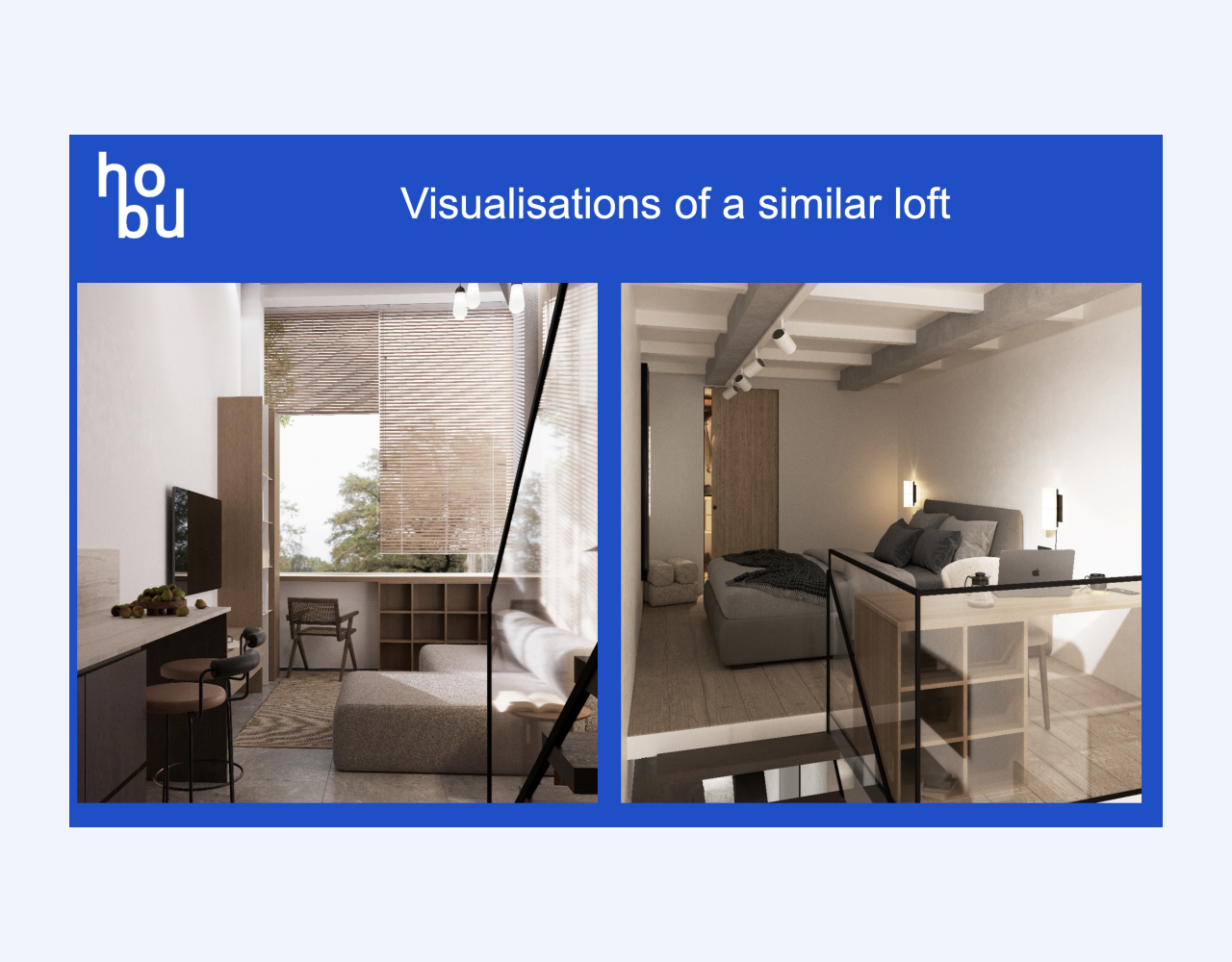

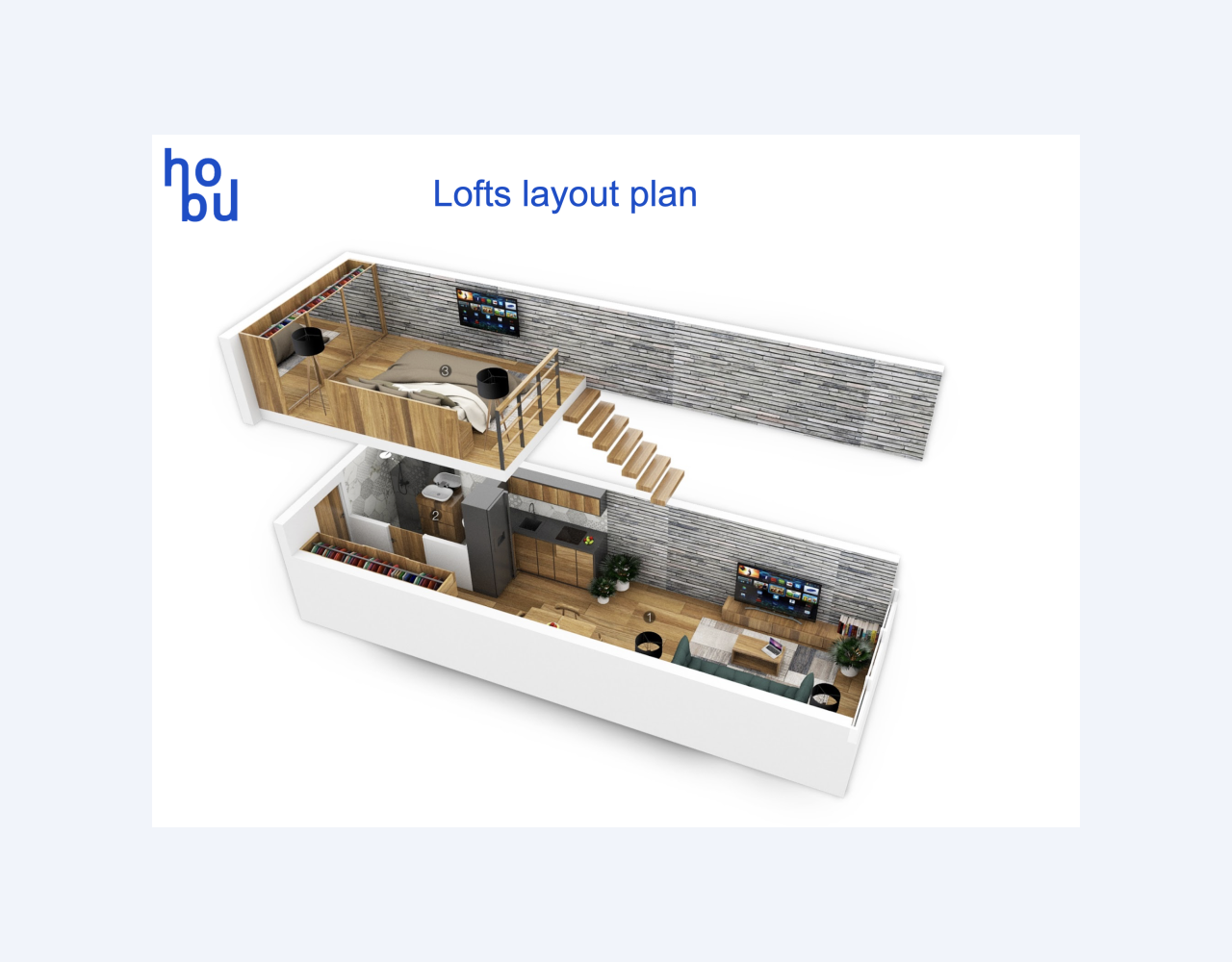

The area of the financed project is 2270.48 m². This building (8224.14 m²) will be modernised and reconstructed. The plan is to create 192 studios-lofts of various sizes for rent.

Currently, the project owner has concluded 51 reservation contracts with the buyers for a total amount of EUR 1,580,266, of which EUR 1,087,976 have already been paid. This increases the attractiveness of the project and reduces the risk for those investing in the project.

Renovation works will start with the insulation of the roof and the decoration and insulation of the façade, the renovation of corridors and staircases, the installation of new armoured doors and plastic windows.

There will also be new utility connections: electricity, sewage, water, and district heating, collector (regulated). The lofts will have mezzanine floors and there will be two elevators in the building.

The owner of the project is Kauno plėtros projektai, UAB. This company is successfully managing another project financed on the InRento platform called K36, Panevėžys.

Investors will be paid a very attractive fixed interest rate of 10% – 10.5% per annum every month, depending on the amount invested.

This project also has a fixed annual capital growth rate of 1.5% payable at the end of the project. This raises the overall yield of this phase to between 11.5% and 12% annual return.

The maximum loan duration for this project is only 6 months. The maximum loan-to-value (LTV) ratio for this project is very attractive at 53%.