Reasons to invest in the project Floatel, Vilnius VI:

The incredible location of the property – next to the Gediminas Castle and Vilnius Cathedral;

The company has all the applicable permits and approvals from the Municipality to establish such a hotel;

Unique buy-to-let project with – Timeshare;

Interest is paid monthly with an attractive annual return of 8% – 8.5% and fixed annual return on capital gains: +2% (payable at the end of the project);

Maximum LTV for the whole project is 70%;

The collateral has been appraised at EUR 1,390,000 by an independent appraiser (detailed information can be found in the appraisal report).

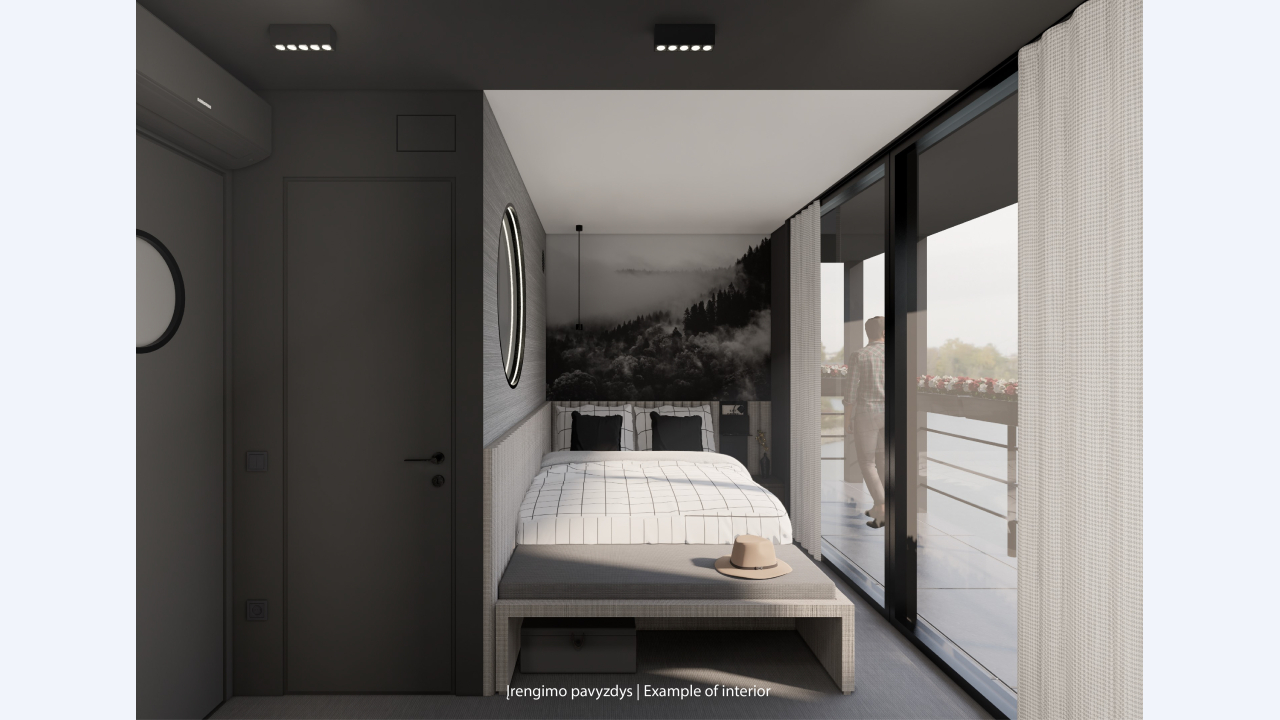

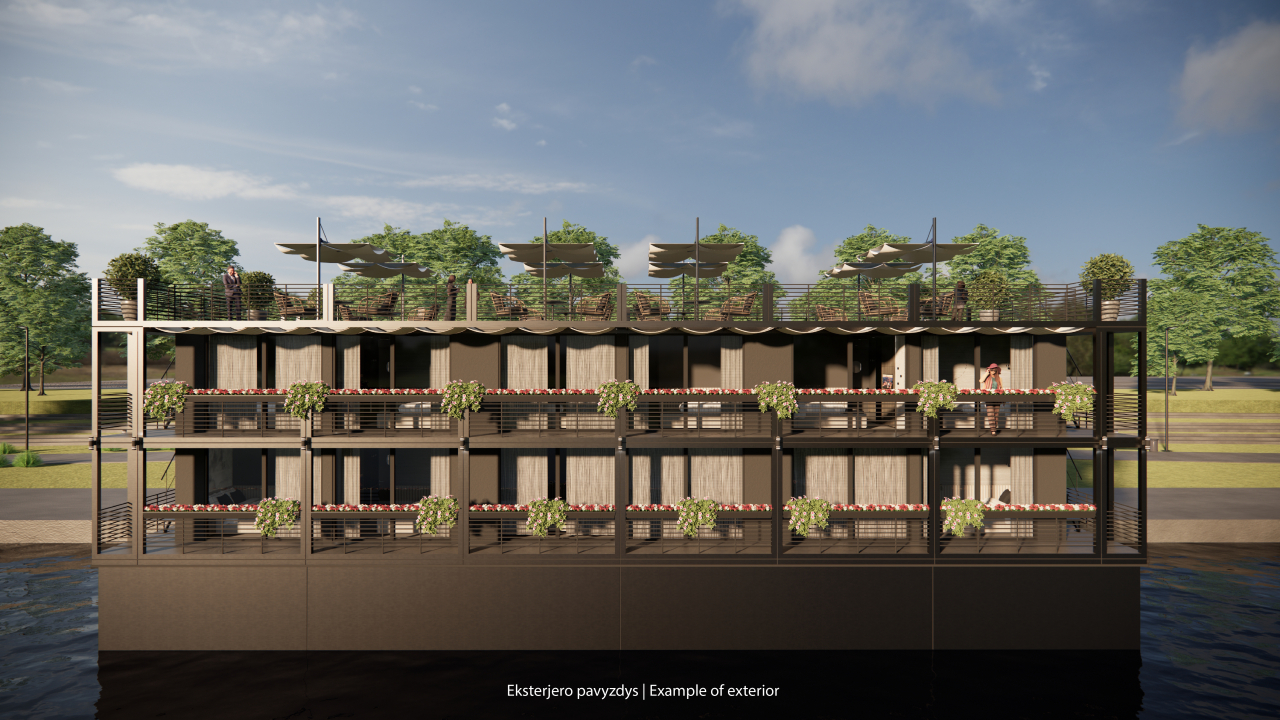

InRento team presents the sixth stage of the unique buy-to-let project – Floatel, Vilnius VI. The investment offer consists of a three-storey hotel on the water with apartments and a restaurant next to the King Mindaugas Bridge in Vilnius.

The project consists of 23 apartments on the first and second floors of the hotel, focused on short-term rentals, and a rooftop terrace-restaurant on the third floor with a great view of Gediminas Castle and the Vilnius Cathedral.

This project is unique in Lithuania – this type of concept is quite popular in many cities around the world due to the attractiveness of the location, as hotels on the water can be built in places where land is not available or where it would be extremely expensive to buy or rent. As a result, higher rental yields can be expected compared to traditional hotels.

This type of project has not only financial but also cultural significance, as unique experiences increase the attractiveness of the city for both residents and tourists.

The owner of the project, Karolis Paulauskas, has over ten years of experience with floating constructions and the oil industry. The project is expected to generate EUR 342,000 in revenue from the apartments, restaurant and bar in the first full year of operation in 2024.

The planned price of the apartments is EUR 65 per night in high season, with an average occupancy rate of 75%, and EUR 45 in low season, with an occupancy rate of 40%. The rent per square metre of the terrace will be EUR 11.

Investors will be paid a fixed interest rate of 8% – 8.5% per annum, depending on the amount invested, every month. This project also has a fixed annual capital growth rate of 2%, payable at the end of the project. This raises the total yield for this phase to between 10% and 10.5% annual return.

The project also has a Timeshare, those investing from EUR 5,000 and up will have the opportunity to book a night's accommodation and stay for free in the Floatel. More information below.

In order to further protect the investors' investment, a building and a plot of land located in the prestigious area of Vilnius – Užupis is being mortgaged in the name of investors, which is valued at EUR 1,390,000.

The project owner is already successfully paying interest to investors for the first stages of the project. The mortgage for this project has already been signed, so the interest for this stage will start to accrue to the investors as soon as the money is actually disbursed to the project owner.