Reasons to invest in the project H2O, Kaunas III:

A unique industrial river waterways buy-to-let project;

One of the fastest developing locations in Lithuania – on the banks of the river in Kaunas;

The project area is 1.1 hectares, the area of the buildings – 2931 m²;

The owner of the project is a profitable company operating for more than 24 years;

Interest is paid monthly with an attractive annual return of 8.4% – 8.9% and fixed annual return on capital gains: +1.5% (payable at the end of the project);

This project's loan-to-value (LTV) ratio is very attractive – 65%.

An independent valuer has valued the collateral’s assets at EUR 638,000.

InRento team presents the last funding stage of a unique industrial river waterways buy-to-let project in Kaunas – H2O, Kaunas III.

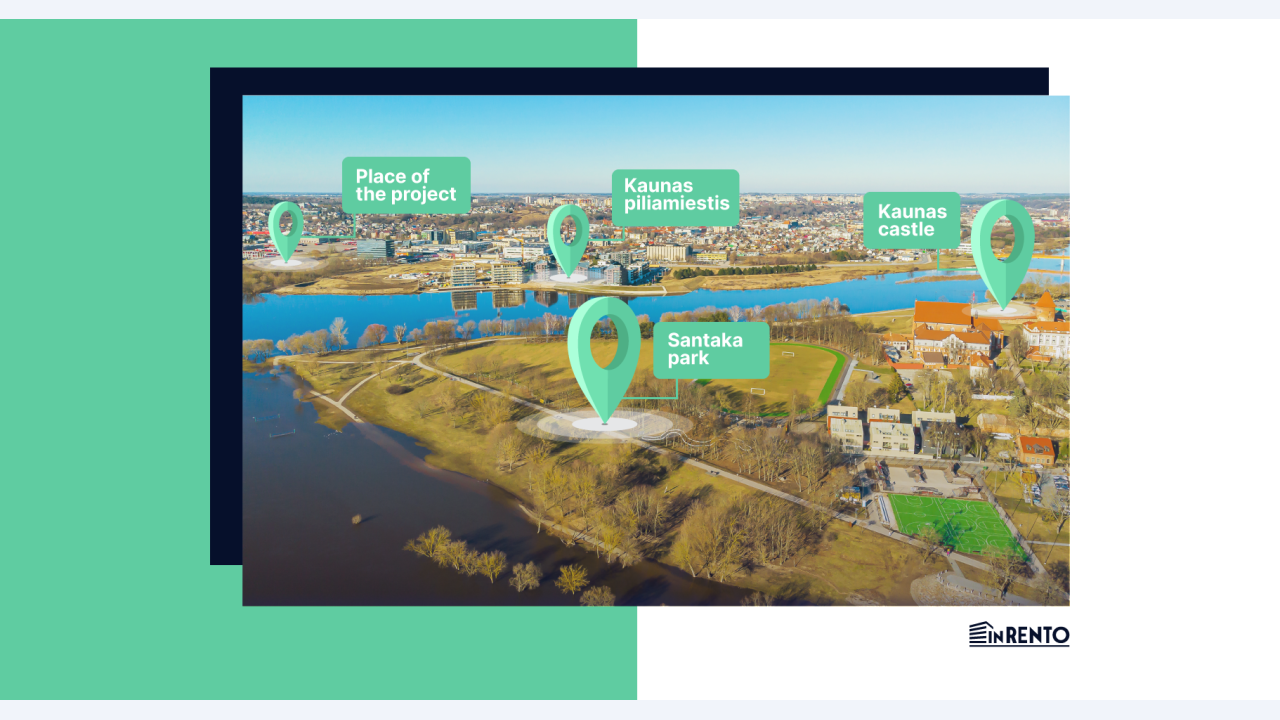

The location of the project is one of the fastest developing places in Lithuania – on the bank of the river, near the Piliamiestis district, at Raudondvario pl. 105A, Kaunas. Conversion of both sides of the river is planned, and up to 20,000 m² of residential development can be developed on the site, financed in accordance with the city's master plan regulations.

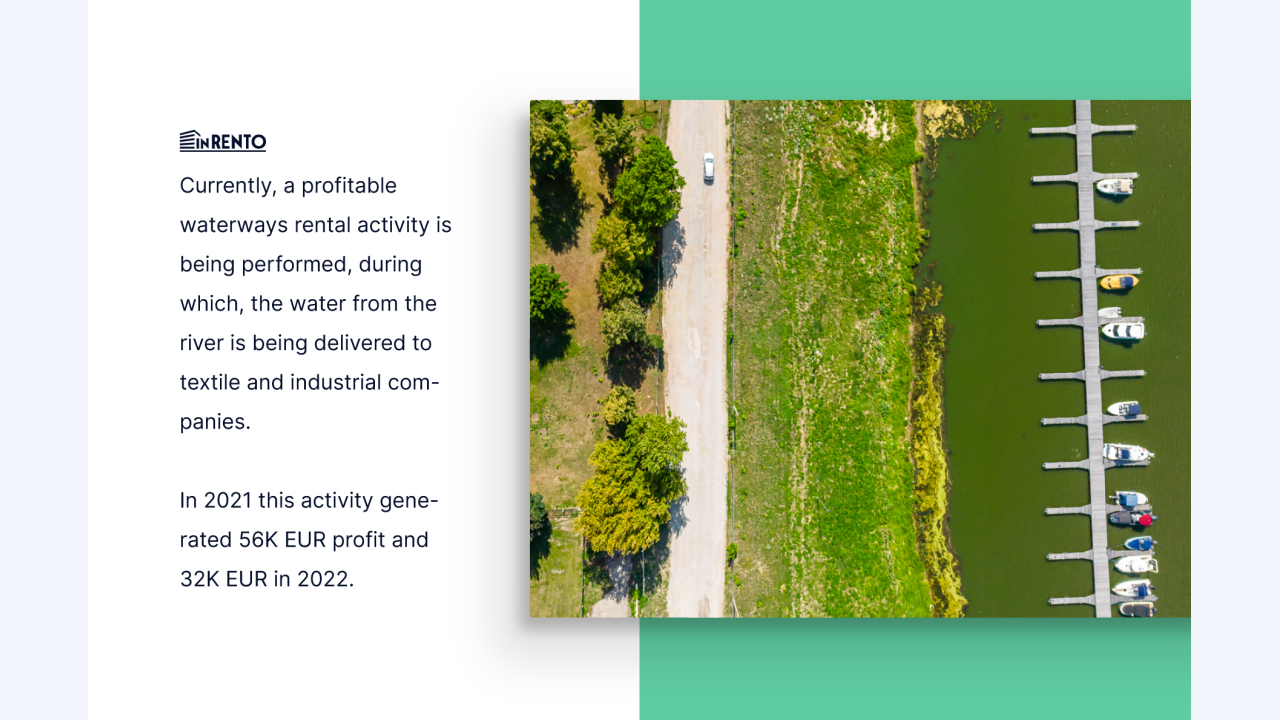

The owner of the project is Kauno Pramoninis Vandentiekis, UAB, a profitable company that provides water to certain factories. The company has been operating for more than 24 years.

The company intends to carry out site planning and design works and to develop a residential buy-to-let project on a land plot for up to 20,000 m².

The project area is 1.1 hectares, and the building area is 2931 m². Nine properties are financed. This project's loan-to-value (LTV) ratio is very attractive – 65%. This reduces the risk for investors in this project. The company will use the financing to refinance existing loans and for working capital.

Investors will be paid a fixed monthly interest of 8.4% – 8.9% per annum, depending on the amount invested.

This project also has a fixed annual capital gain of 1.5%, which is paid at the end of the project. This raises the total yield of the project from 9.9% to 10.4% annual return.

Please note that the mortgage agreement for this project has already been signed, so the interest for this stage will start to accrue to the investors as soon as the money is actually disbursed to the project owner.