InRento team is proud to present the first buy to let project in Spain - I24, La Molina. The investment offer consists of a holiday rental located in the region of Catalonia, at Alp Girona, La Molina, Spain.

Project owner - Tanser Estates S.L. A wide-profile real estate company that administers more than 70 different leisure and residential properties in Spain. Tanser Estates S.L. owns and operates one of the leading booking portals for holiday rentals in Costa Brava, Catalonia region - K3homes.es.

The project owner will pay investors a fixed annual interest rate of 7.25% (as a return on rent). These apartments generate EUR 609 per month for investors, which are distributed in proportion to the amount invested.

The project owner will additionally invest in the installation of the apartment. The kitchen will have a completely arranged ceiling, the apartment will be furnished with furniture and interior details.

Reasons to invest in the project: I24, La Molina -

- Attractive, fixed rental income (interest);

- The building was renovated in 2021;

- The project owner is one of the largest holiday rentals administrators in the region;

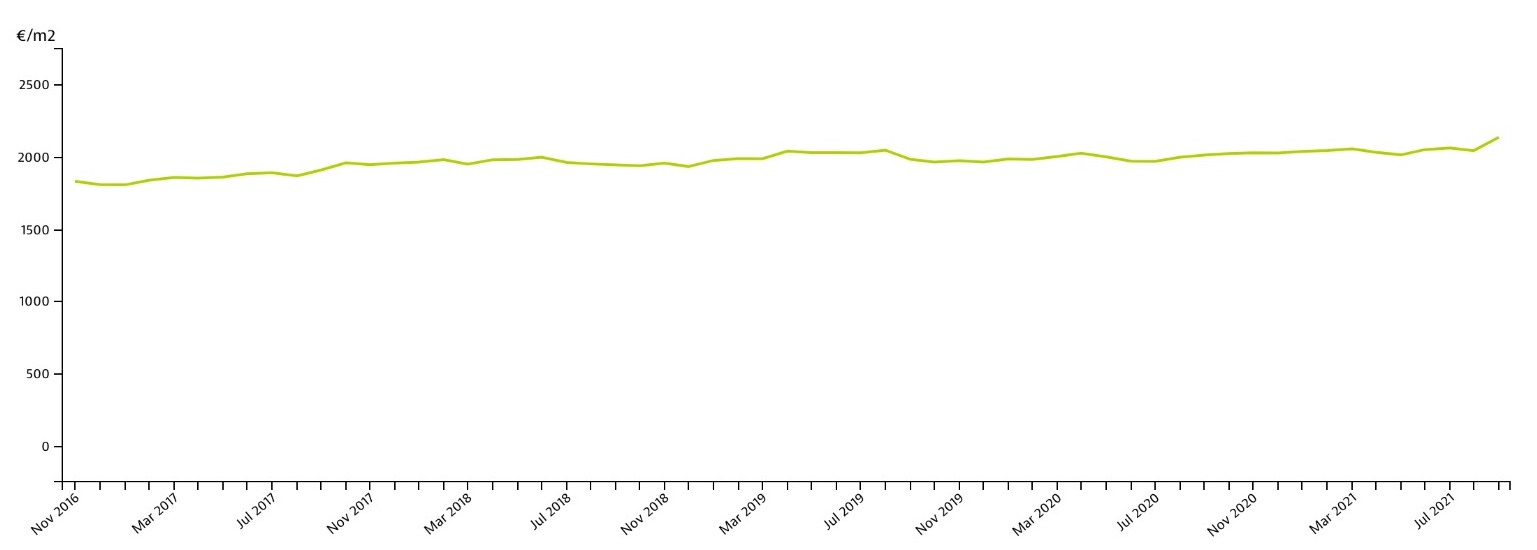

- The property in the area increased 16.6% in the last 5 years;

- Investors will get a right to stay at the apartment for free (more details below);

- The premises were valued by an independent valuer at EUR 100,764.74;

<blur>

The asset:

Located just a few minutes away from the railway station, the property is located just a few kilometers away from ski slopes. The apartment is located on the 2nd floor and has a balcony with a beautiful view to the city and the mountains. The property is being renovated during 2021 and is finishing all the facade works until the end of November, before the skiing season begins. The total area of the apartment is 77 square meters and can host a total of 8 people in 3 bedrooms and the living room.

Changes in capital gains:

According to the latest statistics from idealista.com/en/, the prices of this type of housing in Girona Alp region have increased by +16.6% in the last five years.

Tenants:

The apartment will be rented out using the short-term rental model. The project owner intends to rent it on average nightly for EUR 80 and EUR 120.

According to the AirDNA platform- (leading source for Airbnb analytics), the average price of accommodation in this mountain region is € 153. The average annual occupancy is 23%, but it is worth noting that the statistics provided only analyze data from the Airbnb platform. Actual occupancy is expected to be at least twice higher due to inflow of reservations via Booking.com and K3homes.es platforms.

Financial terms of the investment:

- Maximum term: 84 months (7 years);

- Fixed annual rental income (interest rate): 7.25%;

- Security: 1st charge Mortgage

InRento investors are granting a loan to the borrower. The loan is secured with a first-charge mortgage which in case of the borrower’s inability to fulfil financial obligations would be used to repossess the asset.

Investors in this project have the opportunity to stay free of charge in the apartment:

Investing: 5,000 - 14,999 EUR:

- 1 night during on-season;

- 2 nights during off-season;

Investing: 15,000 - 29,999 EUR:

- 3 nights during on-season;

- 6 nights during off-season;

Investing: 30,000 EUR and more:

- 6 nights during on-season;

- 10 nights during off-season;

On-season: from November 15th, until April 15th;

Off-season: from April 15th, until November 15th;

Reservations must be made at least 2 months before the stay. Contact: alexandra@k3homes.com by email to make a reservation.

The capital growth distribution:

- Investors: 40%

- Borrower: 40%

- InRento: 20%

When investing:

5,000 - 14,999 EUR - the capital growth will be distributed in the following structure: 45% investor / 40% borrower / 15% InRento;

15,000 - 29,999 EUR - the capital growth will be distributed in the following structure: 50% investor / 40% borrower / 10% InRento;

30,000 - 49,999 EUR - the capital growth will be distributed in the following structure: 55% investor / 40% borrower / 5% InRento;

50,000 EUR and more - the capital growth will be distributed in the following structure: 60% investor / 40% borrower;

Rental income (interest):

Rental income (interest) is paid to investors on a monthly basis (on the 25th day of the month). If the 25th day is a non-working day, then the next working day. The first interest payment will take place on the 25th day of the month after the mortgage agreement is concluded.

The project owner (borrower):

Tanser Estates SL - is a company that specialises and operates in holiday rentals management since 2011. Their K3Homes.es booking platform is one of the largest in Costa Brava region. Currently the company is managing more than 70 holiday rentals, which can be seen on - their website.

When is it possible to "exit the project"?

When the project is fully funded you will be able to sell your investment on the secondary market. The fee for the secondary market transactions is 2% of the principal value, which is charged to the seller.

What will happen when the property is sold?

When the property is sold at a higher price than it was acquired, the capital growth will be distributed in the following structure: 40% investors / 40% borrower / 20% InRento. The project owner assumes potential loss if the property is sold at a lower price.

Key investment risks:

Risk of falling prices: The price of the property might fall due to the increase in supply or decrease in demand in the area or other economic factors.

Liquidity risk: The borrower might be unable to find a buyer in order to sell the property.

*Please note that the translations to English and Lithuanian have been completed using uncertified automatic translation.