The InRento team is launching a new buy to let investment opportunity located in Kaunas, Lithuania. The investment case consists of two apartments located in the city center, address: Savanorių pr. 47, Kaunas (referred to as S47, Kaunas). This project has an A Risk Rating.

The building was originally constructed in 1941 and completely renovated a few years ago in 2018. The balconies in the apartments have panoramic views of Kaunas Old Town and main city street - Laisvės avenue.

The area of the apartments: 77.13 m² and 77.29 m². Currently, the apartments are rented out and are generating 2,440 EUR per month in rental income, which results in a 9.44% gross annual rental yield.

The net monthly rental yield is 1,830 EUR which is distributed amongst investors, or as a percentage value equal to 7.08% per annum net, according to the circumstances of the tenancy.

Kaunas is a fast growing city in Lithuania. The last few years have seen a significant increase in the number of real estate projects under development. This is influenced by the establishment of new international companies and the growing attractiveness of the city, which encourages young families to start and live.

Reasons to invest in S47 project in Kaunas:

- Modern and cozy apartments in the city center;

- Complete renovation of the building in 2018;

- Rental income (interest) is calculated from the first day of investment in the project;

- Attractive rental yield;

- The project owner is among “Strongest in Lithuania” by “Creditinfo”;

- The premises have been independently valued at 356,000 EUR.

<blur>

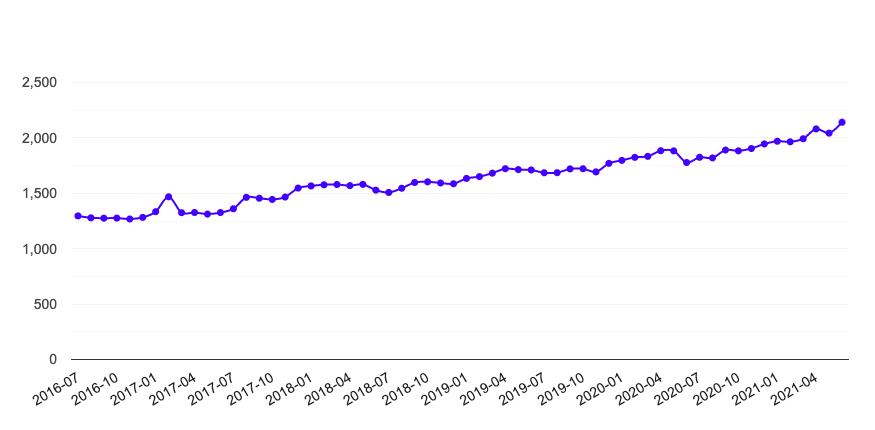

Capital growth change:

According to the latest en.aruodas.lt statistics, the prices of these types of properties in this district of Kaunas increased +17,31% in the recent year, while in the last five years the change was +65,19%.

Source en.aruodas.lt

Tenants:

The tenants are ten natural persons who pay 2,440 EUR per month for rent. Each of them has an individual lease with a one-month lease deposit. In case of the tenant's insolvency, this deposit will be distributed proportionally to investors.

In the last few years, the occupancy of these apartments for rent exceeds 90%.

The project owner sees promising short-term rental opportunities for these apartments when the number of guests and tourists in the city returns to the pre-pandemic level.

Financial terms of the investment:

- Maximum term: 84 months (7 years)

- Rental income share: Investors: 75% / Project owner: 25%

- Fixed-interest rate: 2%

- Increased interest rate: 6.5%

- Security: 1st charge Mortgage

InRento investors are effectively granting a loan to the borrower. The loan is secured with a first-charge mortgage, which in case of the borrower’s inability to fulfil financial obligations would be used to repossess the asset.

The revenue-share between the project owner investors is set at 75/25, meaning that the borrower is obliged to distribute 75% of the income to the investors. Current absolute income is 2,440 EUR per month, which results in 1,830 EUR net income distribution to the investors, or in a percentage value equal to 7.08% per annum with the given situation of the tenancy.

The administration of this project requires a lot of financial and time resources. Taking this into account, the project owner's share of rental income reaches 25%.

The capital growth distribution:

- Investors: 45%

- Borrower: 45%

- InRento: 10%

When investing:

15,000 - 29,999 EUR - the capital growth will be distributed in the following structure: 50% investor / 45% borrower / 5% InRento.

30,000 EUR and more - the capital growth will be distributed in the following structure: 55% investor / 45% borrower.

Rental income (interest):

The funding term for this project is 60 days. Rental income (interest) for investors will be calculated from the first day of investment in the project.

The first interest payment will take place on September 20th.

The project owner (borrower):

UAB ‘’Rego Group“ - is a real estate services company with a wide range of services in its portfolio. The CEO of the company - Andrius Rimdeika is a former investment banker, who has worked in investment firms such as ”Morgan Stanley” and “Prime investment”.

The company specializes in the development and advisory on property cash-flows, additionally, it provides consulting services in the area of Real Estate. More information can be found on their website.

Leading credit-scoring firm - “Creditinfo” has included the project owner among “Strongest in Lithuania”, the list of companies in Lithuania having the highest creditworthiness rating.

When is it possible to "exit the project"?

When the project is fully funded you will be able to sell your investment on the secondary market. The fee for the secondary market transactions is 2% of the principal value, which is charged to the seller.

What happens if the tenants leave the property?

In a scenario of the tenant cancelling the tenancy, the borrower is liable to pay a 2% annual interest rate for the first month of vacancy. If the borrower does not rent out the assets within 3 months, the fixed-interest rate would be increased to 6.5% per annum.

What will happen when the property is sold?

When the property is sold at a higher price than it was acquired, the capital growth will be distributed in the following structure: 45% investors / 45% borrower / 10% InRento. The project owner assumes potential loss if the property is sold at a lower price.

Key investment risks:

Risk of falling prices: The price of the property might fall due to the increase in supply or decrease in demand in the area or other economic factors.

Liquidity risk: The borrower might be unable to find a buyer in order to sell the property.

Tenant risk: Although the assets are currently fully rented out, there is a risk that the asset can lose a tenant and it can take time to find replacements.

Investing with InRento, is similar to owning a rental property, however with us you don't have to worry about day-to-day property management and in the periods of vacancies, the borrower is required to distribute fixed-interest payments, which protects your bottom line.